5 Reasons Netflix Stock Will Nearly Double This Year: Goldman Sachs

Netflix's stock has seen tremendous gains since the turn of the decade and is primed for another significant year. | Source: Shutterstock

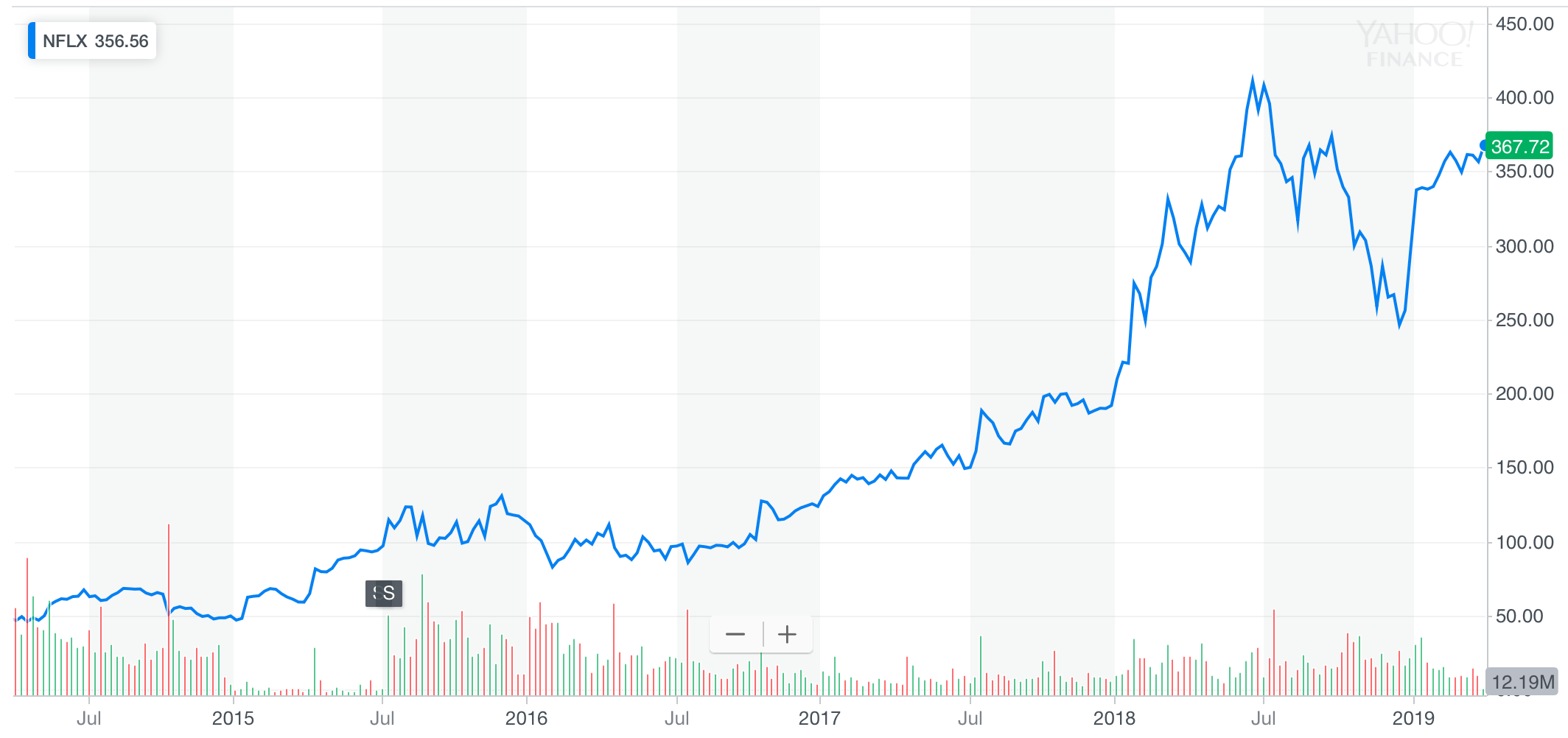

Netflix stock will almost double this year, according to a note issued by analysts at Goldman Sachs . Goldman believes Netflix has 79 percent upside over the next twelve months, giving it a potential price target of $657.

If Goldman Sachs analysts are right, Netflix stock will shoot past its previous record high of $411. Here are five reasons why Netflix has enormous upside.

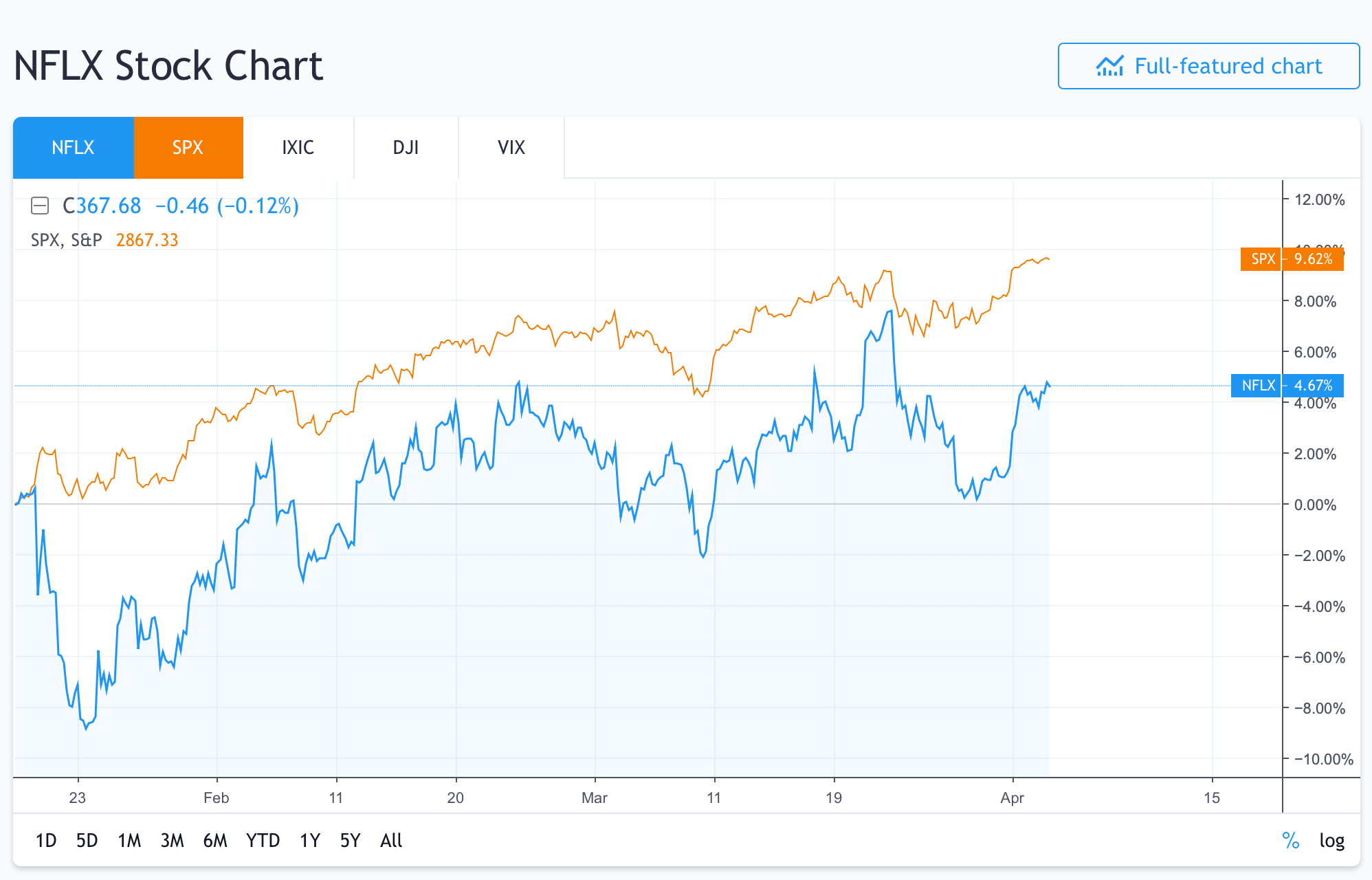

1. Netflix Stock is Lagging the Wider US Market

The S&P 500 has staged a powerful rally in the first quarter of 2019. But Netflix hasn’t ridden the wave.

Since Netflix’s earnings report on January 17th, the S&P 500 has climbed 9 percent. In the same period, Netflix has chalked up only 4 percent gains.

This comes despite strong fundamentals in the Netflix business, as we’ll explore.

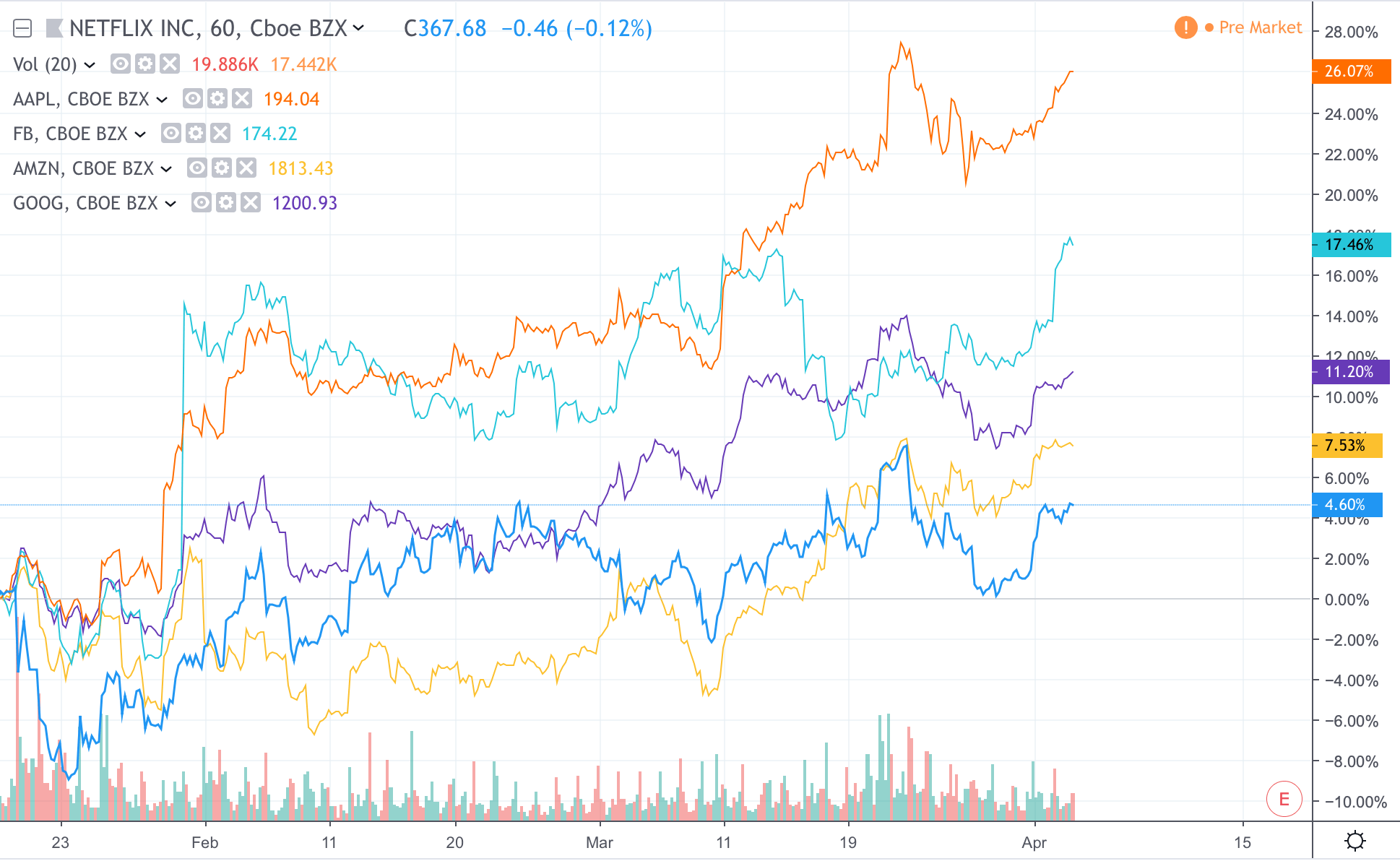

2. Netflix is Lagging All FAANG stocks

Here are Netflix’s gains since January 17th, compared to its FAANG competitors (Facebook, Amazon, Apple, and Google).

- Facebook – 17%

- Apple – 26%

- Amazon – 7%

- Netflix – 4%

- Google – 11%

Netflix is significantly underperforming its peers.

3. Netflix Earnings and Subscribers Are Strong

The disappointing performance over the last three months isn’t reflected in fundamental earnings. Netflix beat expectations in both earnings and subscriber numbers in January, adding almost 9 million new subs.

“I think the numbers are pretty damn good, I guess I’m a little more forgiving than Wall Street” – Jim Nail, analyst at Forrester .

4. Price Increases Haven’t Hurt Subscriber Numbers

One reason for Netflix’s tepid stock performance lately is the upcoming price hike . Netflix is raising its subscription price between $1-$2, depending on your package.

It’s part of a long-term price-rise plan to help Netflix cover costs. Impending hikes always give investors the jitters, but history shows a $1-$2 rise doesn’t have a negative effect on subscriber numbers. There’s no reason to believe it will be different this time around.

5. Amazing Original Content Line Up

Netflix has a bumper year of original content coming up. Stranger Things and The Crown will both launch a third series in 2019; these are tested hits on the platform. There is no slowdown in brilliant content on the service.

What About Apple and Disney?

Not all analysts are aligned with Goldman Sachs. Some have serious concerns about Netflix’s place in the streaming wars. Apple and Disney are both set to launch competing streaming services in 2019 which could eat into Netflix’s market share.

As CCN.com reported, Laura Martin at Needham believes Netflix will suffer at the hands of Apple:

“NFLX has an inferior competitive position to AAPL over time, as we see it, in both: a) customer acquisition costs; and b) content costs. AAPL has zero consumer acquisition costs since it will first target its captive 900mm global unique users, which are the wealthiest consumers in the world. Content costs are lowered by the fact that Apple is creating a storefront service and will get a rev share of subscriptions sold to HBO, Showtime, etc.”

Meanwhile, Mark Zgutowicz at Rosenblatt Securities is more concerned about Disney :

“We believe Disney will be particularly successful because of their intellectual property, history of producing high quality content and balance sheet which enables them to invest substantial amounts of capital in content.”