$5 Billion Wiped Out of Crypto: Bitcoin Below $3,500 Could Spell Trouble

Fundstrat analysts see a weak price structure for cryptocurrency trading and have warned of a new low for bitcoin price in the near future. | Source: Shutterstock

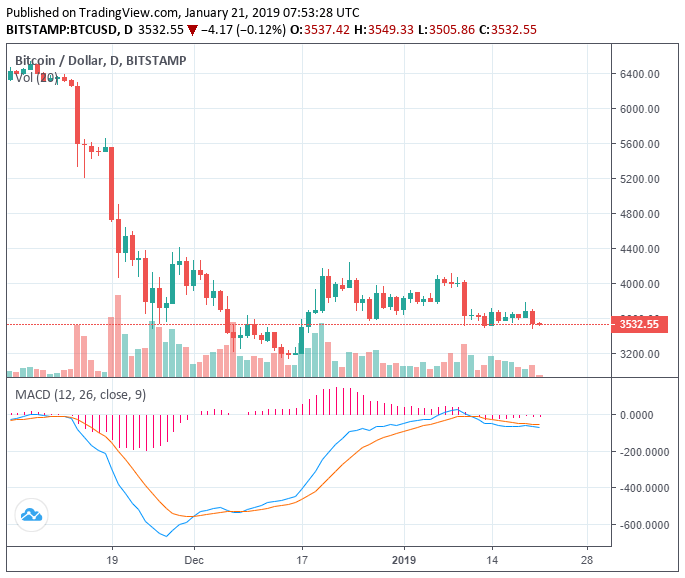

By CCN.com: In the past 24 hours, the crypto market has experienced a slight decline in valuation from $124 billion to $119 billion as the Bitcoin price dropped to $3,500.

Previously, traders said that a drop below the $3,500 mark could lead the price of Bitcoin to test key support levels in the low $3,000 region.

Where the Crypto Market is Heading

On Sunday, the crypto market suffered an unforeseen minor correction as crypto assets such as Ethereum, Bitcoin Cash, EOS took pointed losses.

DonAlt, a cryptocurrency trader, said that a short-term fall to the $3,400 mark is a likely move for the dominant cryptocurrency.

He said:

Perfectly responded to the drawn level. $3,500 has acted as support 3 times already if it is hit another time I’d expect it to break. Finally approaching a level ($3,400) that I might trade again. Until then still sitting tight fully hedged.

A continuous drop in the price of Bitcoin to the lower region of the $3,000 region may result in an intensified downward movement for major crypto assets.

On the day, Ethereum, which has fallen below Ripple and has become the third most valuable cryptocurrency in the global market, dropped by more than six percent against the U.S. dollar.

Hsaka, a cryptocurrency technical analyst, said that the three percent drop in the price of Bitcoin could result in a further decline in value but it is unlikely that it would lead the asset to test its 12-month low at $3,122.

“Yesterday’s sell the rally analysis played out like a beauty. Bounced before the $3,430 support level. Took out lows (green dashed) of this consolidation. Neutral here, not shorting into HTF support. Covered my BTC short, holding ADA and BCH,” the analyst said .

Volatility in a Low Price Range

Throughout the past few weeks, analysts in the likes of Willy Woo have predicted the bear market to extend across the first two quarters of 2019.

On January 2, a cryptocurrency researcher with an online alias “The Crypto Dog” said that while the cryptocurrency market is close to bottoming out, in the short-term, the market will not see new highs of significant rallies.

“BTC has mostly bottomed (might even have put the final low in) but we’re not going to see a significant rally or new highs for a while so that’s not much to get excited about. Cheers to a boring 2019,” the researcher said.

Analysts generally believe the cryptocurrency market is en route to seeing a boring year in 2019 in terms of trading activity and volatility. Although the cryptocurrency market has shown a relatively high level of volatility in January, most crypto assets including Bitcoin have remained in a tight price range, unable to break out of key resistance levels or drop below important support levels.