Study: 43% of Bitcoin Transactions Aren’t Processed after First Hour

A new study by the UCL Centre for Blockchain Technologies reveals that “43% of the transactions are still not included in the Blockchain after 1h from the first time they were seen in the network and 20% of the transactions are still not included in the Blockchain after 30 days, revealing therefore great inefficiency in the Bitcoin system.”

The bitcoin network was studied over a period of three months where some 12,000 unique nodes were found to be connected with confirmation times less inefficient for large value transactions. The study says:

“In this case, we note that the process is still rather slow but most of the value is included in the Blockchain within 3h (93%) and after 30 days only 0:1% of value is left to be included.”

The study makes a number of interesting claims. They say, for example, that nearly 200,000 blocks were received during a one week period when only around 2,000 blocks were “real” or relevant. Giuseppe Pappalardo, a Research Assistant at UCL and one of the paper’s author, explained this discrepancy to CCN.com as follows:

“When a node receives a block it has to verify all transactions included in the block and the whole block itself. If both transactions and the block are valid, the block is announced to the node’s peers using the inv message. So when a node send to us an INV message related to a block/transactions it should imply that the block passed verification.

The massive presence of dated “echo block” sent by a large group of nodes can be due to the fact that not all nodes maintain a full copy of the blockchain and therefore are unable to verify blocks. Another scenario could be that these nodes are not performing any verification at all.

Without proper verification, old blocks keep [being] broadcasted by peers in a loop.”

That appears to be a clear inefficiency as many resources are being used for no good reason. Regarding transactions themselves, it’s not clear whether the amount of fee paid and its role in transaction inclusion was studied, with the authors instead only differentiation between small value and large value transactions, leading to an interesting statement:

“The Bitcoin system fails in taking accurate record of the transactions with some of them taking months before being recorded in the Blockchain. We note that this inaccurate recording does not seem to be caused by the fact that block size is limited to 1MB and only few thousands transaction can be included into a block. It seems indeed that the network is not saturated yet, with average block size 0.8MB, with only 3% of blocks exceeding 0.99MB band and even with some blocks without transactions.”

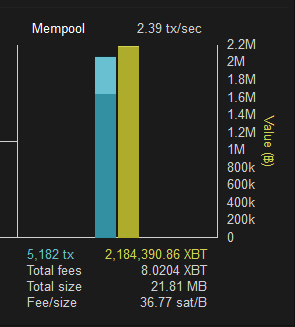

The study was undertaken around May last year just before blocks became full with Blockchain.info reporting that the current average blocksize over the past 24 hours is 0.96MB. Since last year, transaction backlocks have become far more common, with more than 2 million bitcoins, worth around $2.5 billion, currently waiting to move.

Inefficient Transaction Processing

However, the study does point out that regardless of the blocksize there remains “no mechanisms that ensures that all transactions are actually processed,” as miners are free to choose what transaction, if any, to include in their block.

Nakamoto did include a mechanism, but it’s not enforceable as it’s not at a protocol layer. That is what’s called first-seen. Nodes/miners are meant to process the first seen transaction, so forming a queue through this method, but it breaks down with full blocks. Without full blocks it remains unenforceable, but since it’s a logical way of processing transactions most miners would probably apply it as they did prior to full blocks.

The added benefit of first seen is that double spends are very difficult – although possible through a miner who does not use first-seen – even when the transaction has no confirmation. Making bitcoin’s transactions as good as instant in most cases, especially in physical settings.

It’s not clear whether the authors are aware of the first seen mechanism which has now largely been superseded by a fee-paying prioritization method. Pappalardo says that further investigation is needed to ascertain why some transactions are not included, before adding:

“What we suggest is that miners have no incentives to include all transactions and therefore some are missed and after a while becomes increasingly unlikely that a miner willingly include old transactions.”

Pappalardo further said that “despite the intentionally-provocative negative view on the bitcoin network efficiency, at the UCL Centre for Blockchain Technologies we strongly believe in the great potential of blockchain and its peer consensus mechanism. With this paper we call for a debate on the right system of incentives to make a peer-to-peer blockchain system efficient in recording transactions correctly and timely.”

Asked what system of incentives might improve efficiency, Pappalardo said that “without any incentive for proper processing and timely recording of transactions it is unlikely the system will spontaneously invest efforts to become more efficient.”

The Blocksize Debate

This topic has been a matter of public debate, for now, two years with some suggesting the base layer should be kept inefficient through enforcing an upper limit of 1MB blocks so that everyone uses the Lightning Network, while others arguing for the reinstatement of the first seen mechanism through lifting the 1MB limit.

Those arguing for a retention of the inefficiency have gained the upper hand by blocking any changes to the protocol, including the latest proposal of extension blocks. The end result is that now almost half of bitcoin transactions need to wait for more than an hour with independent studies proclaiming bitcoin’s payment network is inefficient.

Whether such inefficiency will be addressed in bitcoin remains to be seen, but scientific and impartial independent studies are always a welcomed addition to the never ending blocksize debate.

Featured image from Shutterstock.