3M Stock’s Collapse Deals Vanguard a $10 Billion Catastrophe

3M stock's double-digit plunge will deal a major blow to the three institutions who collectively own more than 20 percent of all outstanding MMM shares. | Source: AP Photo / Richard Drew

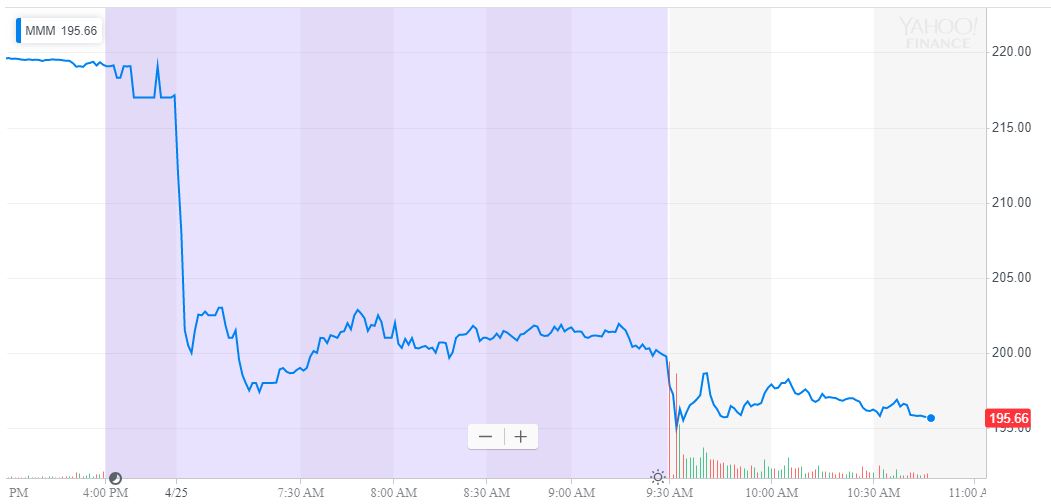

By CCN.com: 3M stock (MMM) plunged by 11 percent on Thursday after the $112 billion company unveiled disastrous first-quarter earnings , drastically slashed its full-year guidance, and announced that it would hand out pink slips to 2,000 employees as part of a radical restructuring plan.

But while analysts will justifiably blame 3M for hamstringing the Dow Jones Industrial Average as it seeks to record its first all-time high since October 2018, the Post-it maker also dealt a significant blow to the institutions who own 69 percent of outstanding MMM shares.

Vanguard Owns $9.5 Billion Worth of 3M Stock

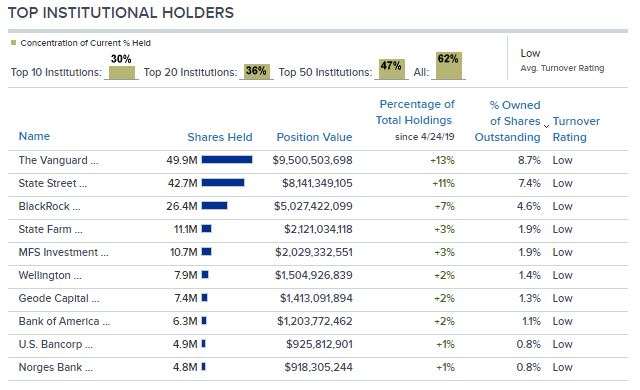

The largest institutional owner? Investment management giant Vanguard, which oversees nearly $10 billion worth of shares in the embattled company.

Vanguard owns a staggering 49.9 million shares of MMM stock, worth a combined $9.5 billion. Vanguard’s stake accounts for 8.7 percent of all outstanding 3M shares.

Among mutual funds, Vanguard’s Admiral Shares index funds will suffer the greatest blow in real dollar terms. The Vanguard Total Stock Market Index Fund (VTSAX) retains $3.25 billion worth of 3M stock or 2.7 percent of outstanding MMM shares. That accounts for roughly 1.5 percent of VTSAXs $213.56 billion in net assets. The Vanguard 500 Index Fund (VFIAX) is the next-largest holder of 3M, with 11.2 million shares worth $2.3 billion.

Altogether, 10 institutions maintain a 30 percent ownership stake in 3M stock, with State Street (7.4 percent), BlackRock (4.6 percent), State Farm (1.9 percent), and MFS Investment Management (1.9 percent) rounding out the top 5.

Insiders Dumped MMM Stock All Quarter

The major Dow component’s disastrous earnings report stunned Wall Street, but perhaps investors should have seen this coming.

According to CNBC , 3M insiders began rapidly dumping the stock in January 2019 and continued to unload shares throughout the first quarter. The sell-off peaked in February when the insider Sell/Buy ratio jumped to an eye-popping 14:1.

So will the 116-year-old company be able to rebound in the near future? Don’t count on it, warns Melius Research CEO Scott Davis. Speaking in a post-earnings interview on Monday, Davis said that 3M has a reputation as a “sleepy company” that’s always several quarters behind the curve.