3 Stocks to Short to Make a Killing from Trump’s Mexico Tariffs

Trump's Mexico tariffs could cost the U.S. economy a crippling $86 billion, but aggressive investors can make a killing by shorting affected stocks. | Source: Shutterstock. Image Edited by CCN.com.

By CCN.com: President Trump’s shock announcement that he would impose tariffs on all Mexican imports rocked the stock market last week, but the White House-induced volatility creates the perfect storm for investors to make a killing by aggressively shorting several Mexico-linked companies.

Here are three of your best bets:

1. Constellation Brands (STZ)

Constellation Brands, which makes popular Mexican beers like Corona and Modelo, is a prime target for short-sellers who believe Trump will follow through on his threats to hike tariffs as high as 25% on Mexican imports.

On Friday, the company’s stock had its bloodiest single-day loss since January, spilling 6% of its market value on the Mexico tariff announcement.

https://twitter.com/Market_Screener/status/1134524475544879109

An analyst at Morgan Stanley says the company imports 75% of its beer offerings from Mexico and estimates its profits will go flat by as much as 19% when the full 25% Mexico tariff kicks in this October.

That will make for some bitter beer – and some intoxicated short sellers.

Similar stocks to short: Chipotle Mexican Grill (CMG) and Calavo Growers (CVGW)

2. Royal Dutch Shell (RDSA)

Royal Dutch Shell stock fell just 0.61% in trading Friday, but expect the worst to come. That’s because this oil and gasoline titan is the largest U.S. importer of crude oil from Mexico.

Shorting this stock is a good hedge against financial losses to tariffs on Mexican imports. Moreover, it’s a hedge against recession on the horizon as Trump’s global trade war heats up.

Oil prices are usually affected by recession as demand for fuel drops. They were in the last great recession. Over the long term, companies like Shell must face a reckoning anyway with the imminent arrival of global scale carbon-free energy alternatives.

Similar stocks to short: Valero Energy (VLO) and Chevron (CVX)

3. General Motors (GM)

“Automakers have long built vehicles in Mexico, taking advantage of the proximity to the U.S. and the cheap labor. The U.S. imported 2.7 million cars across the southern border last year alone. Cars, trucks, buses, and auto parts are Mexico’s biggest export items to the U.S. totaling $93.3 billion last year.” -CNBC, Squawk Box (May 31, 2019)

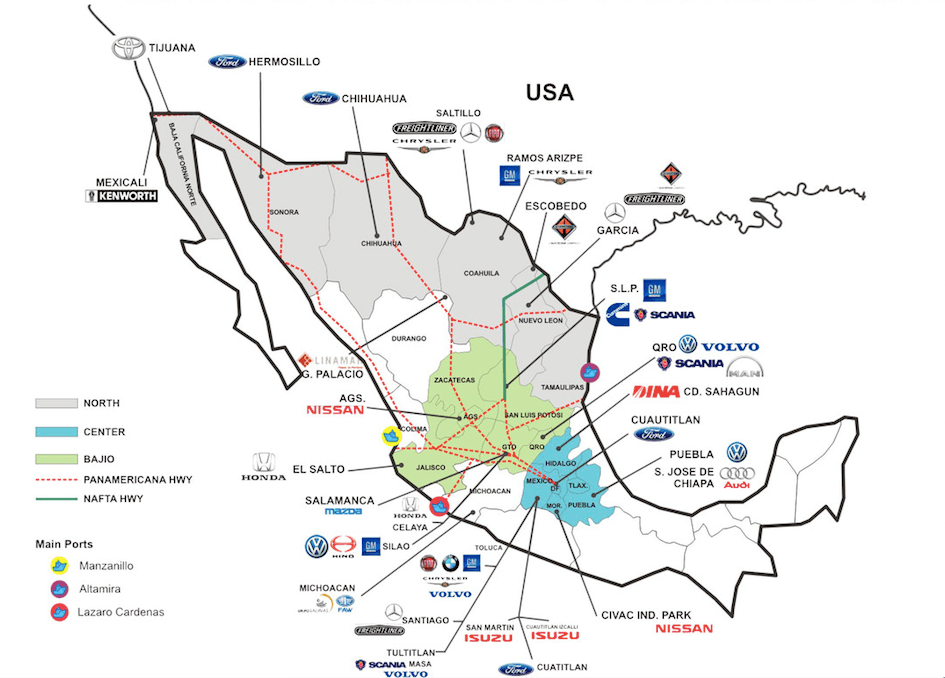

Shorting the U.S. auto industry is a very sensible hedge against both Trump’s Mexico tariffs and market recession signals. No sector will bear the brunt of the Mexico tariffs like the U.S. “Big Three” automakers: General Motors, Ford, and Chrysler. These three companies all have billions of dollars at stake in the new front of Donald Trump’s trade war.

GM rang in 2019 as the biggest automaker in Mexico, even as it closes down plants in Michigan, Ohio, and Ontario. Even automobiles that are manufactured in the United States are almost always made using parts and heavy industry imports from Mexico.

Big Three Stock Will Fall ‘Like a Rock’

Shares of General Motors, Ford, and Chrysler already began to plummet in Friday trading on news of the Mexico tariffs.

As the tariffs ramp up and falling bond yields signal recession ahead, there’s likely a lot of room left between here and the bottom.

Similar stocks to short: Ford (F) and Fiat Chrysler (FCAU)

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.