3 Reasons Why a Post-Coronavirus Stock Market Rally is Delusional

The unprecedented COVID-19 wrecking ball has pummelled the global economy to its knees and and there's little hope for a V-shaped recovery. | Source: Spencer Platt/Getty Images/AFP

- The U.S. stock market is unlikely to see a V-shape recovery in the near-term.

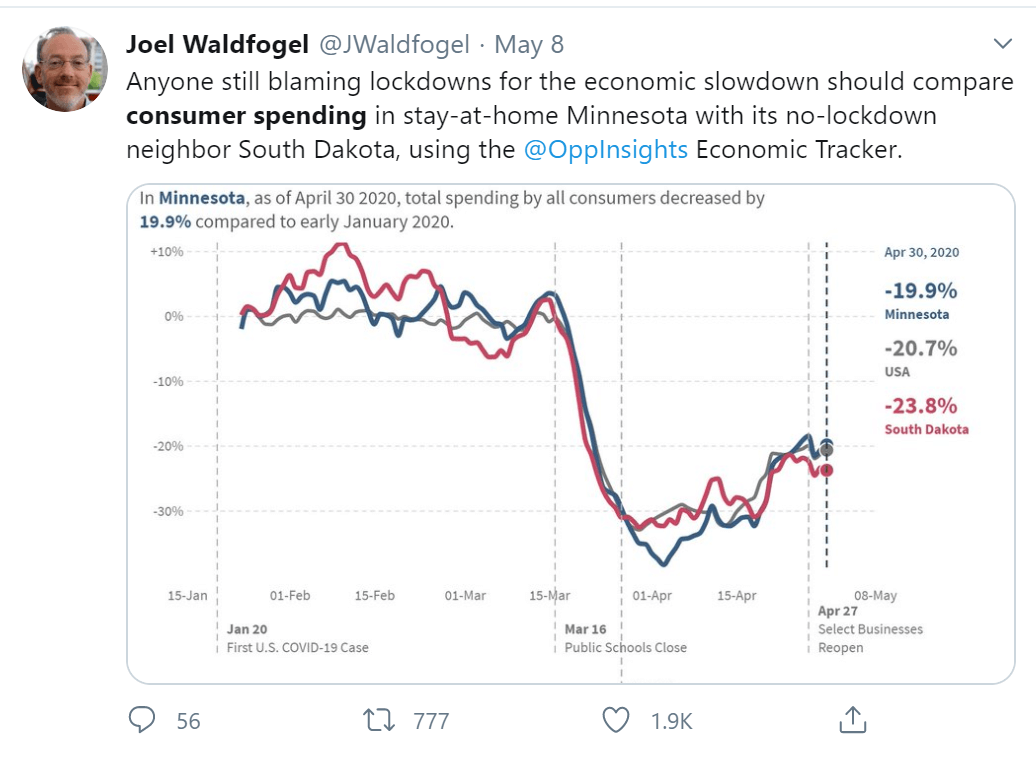

- The declining jobs market, drop in consumer spending, and the distrust of billionaires in the financial system strain the market.

- Consumer spending dropped to levels unseen since the 1980s.

The U.S. stock market faces severe risks that may spoil the ongoing recovery. While retail investors hope for a post-coronavirus pandemic uptrend, key data points suggest a V-shape rebound is premature to call.

Three factors that make a continuous stock market upsurge unlikely are declining consumer confidence, high unemployment rate , and the distrust of big money in the financial system.

Factor #1: Consumer Spending Will Decline

When the U.S. economy reopens, people will spend less money at malls, shops, and offline stores.

The economic impact of the coronavirus pandemic on the U.S. will last throughout 2020, especially if the virus turns out to be seasonal as studies suggest.

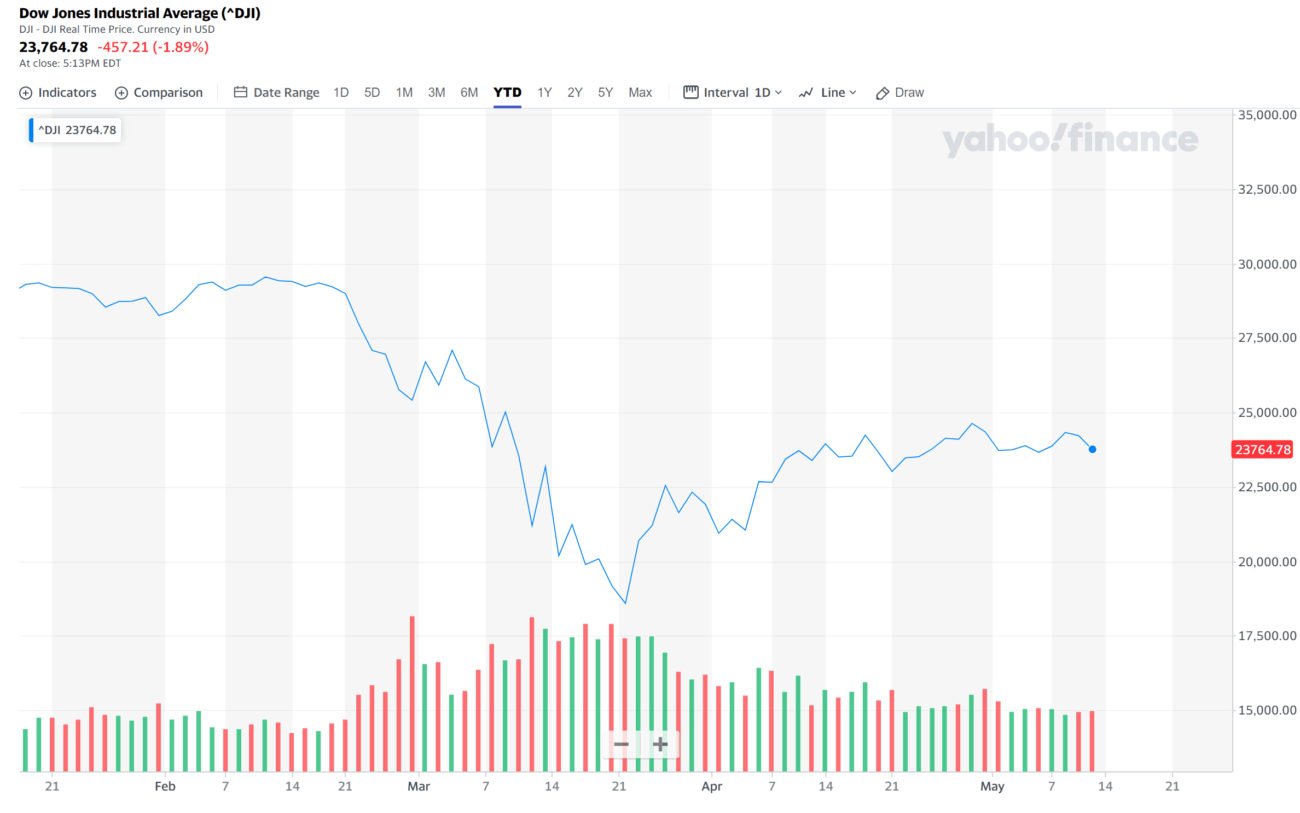

The stock market is up by 30% in the past month as many retail investors turned toward equities while stay-at-home restrictions were implemented.

But, British banking giant Barclays warns a “radical” shift will be seen in American spending habits in the second half of 2020.

Businesses are struggling due to economic uncertainty, a drop in business productivity, mounting geopolitical risks , and disruption in supply chains.

As the productivity of businesses fail to recover, the strain on the jobs market will inevitably increase. When job numbers do not increase despite the reopening of the economy, the stock market is expected to react negatively.

According to Michael Gapen, head of U.S. economics research at Barclays, the effect of coronavirus on consumer spending could last years.

Gapen said :

Consumers have cut back on a wide variety of non-essential spending.

The researcher went onto emphasize that the job market may require two to three years to recover.

Factor #2: Lost Jobs Won’t Be Back Right Away

Businesses that fired millions of employees merely a month ago will not rush to hire people back when the U.S. economy opens.

There are many risks that both small and large businesses have to weigh in.

For instance, for a large manufacturing business, supply chain issues could continue to cause major problems as border control between countries tighten.

Dr. Anthony Fauci also emphasized in a Senate Testimony that reopening the economy comes with enormous risks of causing another outbreak.

Businesses will remain cautious because all of the measures governments across the world are taking currently are experimental.

If the unemployment in the U.S. remains high throughout 2020, it is likely to prevent households from spending, affecting the earnings of key companies in the U.S. stock market.

Major sectors like retail, travel, and manufacturing face bigger challenges ahead as the U.S. prepares to ease lockdown measures.

Factor #3: Big Money Remains Convinced

Stan Druckenmiller, a hedge fund manager with a net worth of $4.7 billion, dismissed expectations of a V-shape recovery to claim they’re “a fantasy.”

Druckenmiller said that he foresees a cascade of bankruptcies in the future, regardless of the efforts of the Federal Reserve to boost the economy.

The investor warned :

I pray I’m wrong on this, but I just think that the V-out is a fantasy.

A confluence of lacking confidence from billionaires, gloomy prospect of the job market, and declining consumer spending reduce the probability of a stock market uptrend.