3 Reasons Why Shorting McDonald’s (MCD) Stock Now Is a Bad Idea

McDonald's stock may have fallen on hard times, but the company's aggressive buy-back strategy could burn short-sellers. | Image: REUTERS/Shannon Stapleton/File Photo

- A slew of negative developments that includes missing third quarter estimates and the firing of the CEO are giving investors ammunition to short McDonald’s.

- Technical analysis of the shorter and longer time frames reveal that the fast food giant is likely to bounce.

- McDonald’s is also aggressively repurchasing shares, which increases the odds of shorts getting liquidated.

Many investors are bearish on McDonald’s (NYSE:MCD), and understandably so. The fast food chain missed key estimates in its third quarter earnings report . On top of that, the company’s board recently fired its CEO Steve Easterbrook for dating a fellow employee. Having a consensual relationship with an employee is a violation of company policy. Lastly, McDonald’s appears to be losing bullish steam as the shares are down by over 11% from the all-time high of $221.93.

The series of unfortunate events for the fast food giant is driving investor sentiment. It appears that retail traders are so bearish on the stock that even a partially deflating Ronald McDonald balloon is seen as a short signal.

Nevertheless, shorting McDonald’s at current levels is not a good idea. Here are three reasons why.

1. McDonald’s Is Ripe for a Bounce

McDonald’s lost all bullish momentum after it broke down from a textbook head and shoulders top in October. This led to a waterfall event that saw the equity drop to as low as $187.55 on Nov. 4. At that point, bulls were able to stop the bleeding. They managed to hold support of $188.

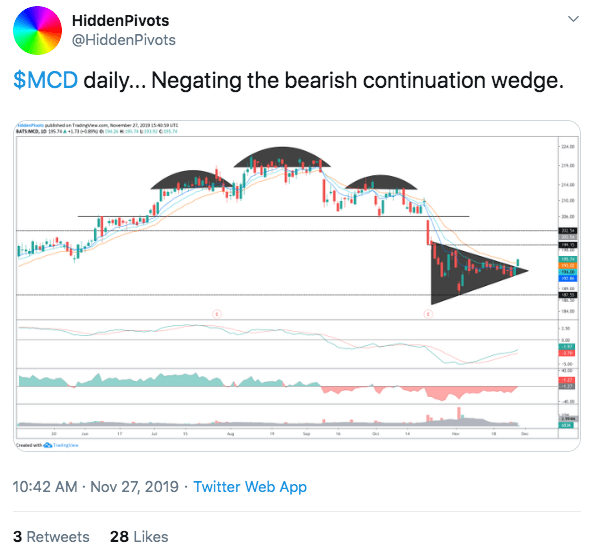

Trader Hidden Pivots closely followed the action. He sees a possible bounce on the horizon after MCD negated the bearish continuation pennant.

2. McDonald’s Looks Bullish in the Longer Time Frame

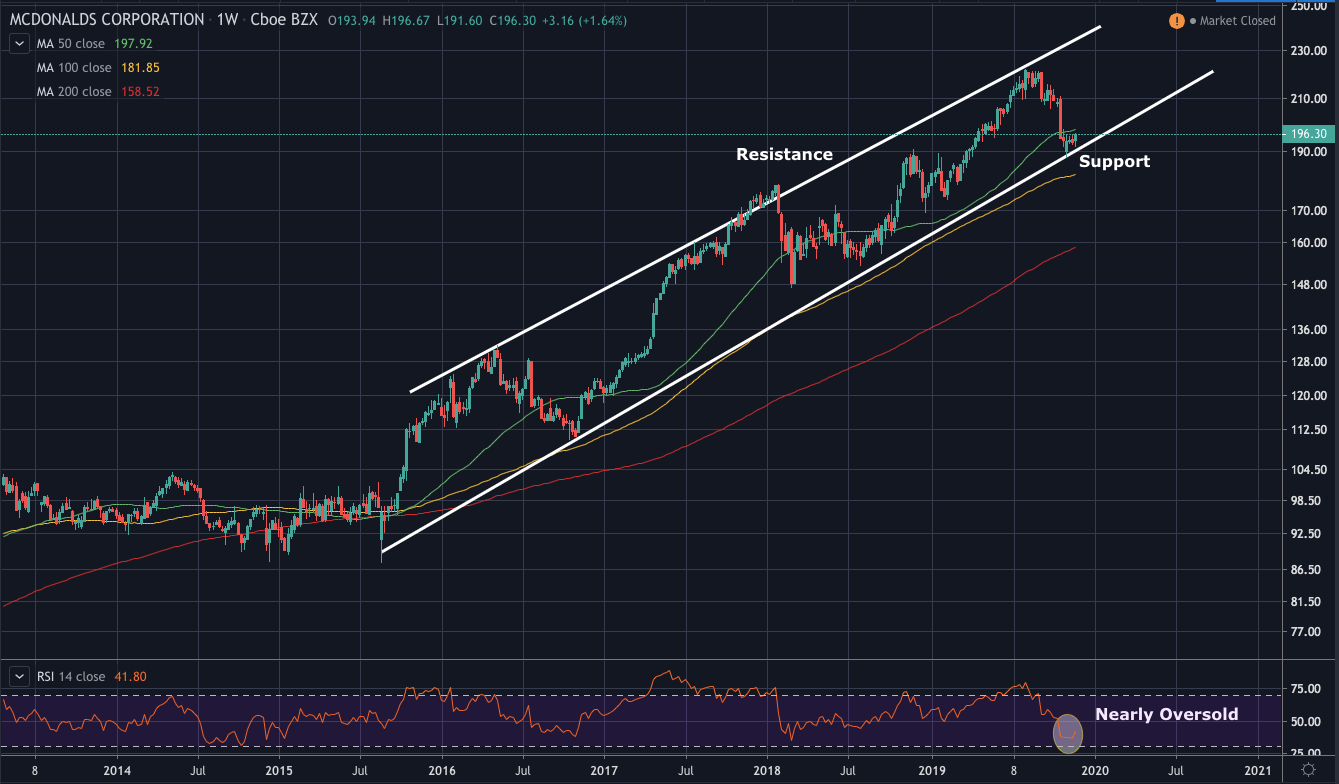

Shorting a stock that’s macro bullish can quickly backfire. This is especially true if technical indicators are flashing close to oversold readings. These are the signals that I am seeing in McDonald’s.

The weekly chart tells me that MCD is trading within an ascending channel, which is a bullish pattern. In addition, the stock is sitting very close to the uptrend support while indicators say that MCD is undervalued. This long-term technical picture tells me that the equity is more likely to resume its uptrend than breach a support that has been driving prices higher since 2015.

Thus, it might be a fool’s errand to short the stock at current levels.

3. McDonald’s Stock Buyback Royalty

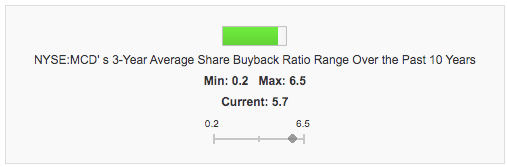

McDonald’s is one of the companies that invests heavily in stock repurchases. In the last three years, the fast food giant has scored an average buyback ratio of 5.7 out of 6.5. To put that in perspective, MCD’s three-year average buyback ratio is higher than 95% of the 228 companies in the restaurant business .

The numbers add up. Marketrealist reports that in the last three years, McDonald’s spent $25 billion to reward shareholders in the form of stock buybacks and dividends. In the first three quarters of 2019, the company has bought back over $3.53 billion worth of shares.

If you plan on shorting the stock, know that you are going against a company that’s aggressively buying back shares. Would you be willing to make that bet?

Shares of McDonald’s may be down big from the all-time high but shorting at current levels may not be a wise move. Signals tell me that the stock is more likely to bounce now than to continue descending.

Disclaimer: The above should not be considered trading advice from CCN.com. The writer does not own McDonald’s (MDC) shares.