3 Mega Bullish Triggers That Can Set the Cryptocurrency Market on Fire

These three events could send the cryptocurrency market moon-bound. | Source: Shutterstock

By CCN.com: In investing, there’s a saying that goes, “a rising tide lifts all boats.” This adage rings true even in the cryptocurrency world because when one token becomes bullish, it is likely that other altcoins turn bullish as well. The bullish sentiment tends to get more infectious as more people hop on the bandwagon. In addition to that, profits tend to move from one cryptocurrency to the next. We’ve seen this happen early this year with the smart money pumping the large caps first, then the mid caps, and the small caps last.

With this maxim in mind, you can exponentially grow your capital by simply anticipating events that can catapult one cryptocurrency. Here are the mega bullish events that can set the cryptocurrency market on fire.

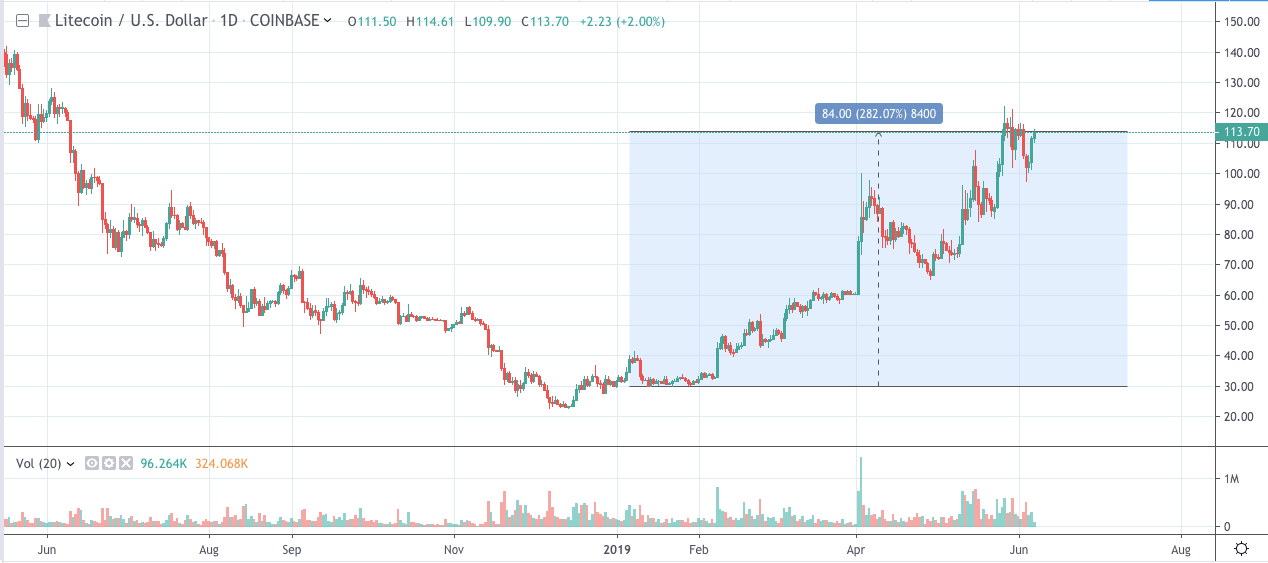

Litecoin Halving – August 6, 2019

The Litecoin halving is one of the most anticipated bullish events of 2019. On August 6th, block rewards will decrease from 25 to 12.5 coins . The anticipation has reached fever pitch levels as Litecoin is up by over 283 percent year-to-date.

Even though Litecoin is up by more than three times its value when it opened the year, we believe that there’s room for more growth. The cryptocurrency will likely soar to $220 before the halving as retail traders experience the fear of missing out (FOMO). When the smart money begins to dump their positions on FOMO’ing retail traders, they will likely rotate profits to other coins. The rotation can ignite a mini bull run.

Ethereum Transition to Proof-of-Stake – 2019 (Estimate)

Ethereum’s change from Proof-of-Work (POW) to Proof-of-Stake (POS) is another event that can spark a mini bull run. Before the implementation of the POS, miners who want to become validators in the new decentralized system must accumulate tons of Ethereum. Keep in mind, the rewards that validators get depend on their stake. For instance, if the validator owns 1 percent of the coin as their stake, they get one percent of the rewards.

The bullishness of this event is magnified when you understand that each validator must own at least 1,500 ETH to participate (~$373,500). This can start an Ethereum arms race that can push prices up to FOMO levels. When this happens, the smart money who longed early will dump their positions and move their profits to other coins.

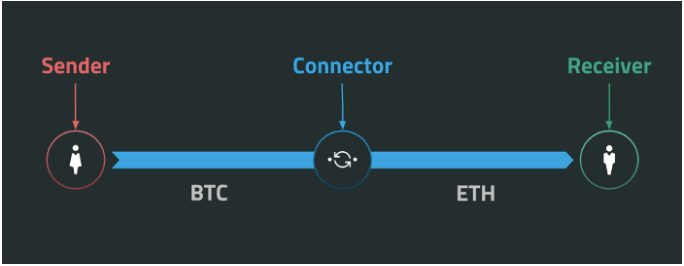

Ripple’s Interledger Protocol (ILP) – 2020 (Estimate)

Ripple is set to take over the cross-border payments system and spark widespread crypto adoption with the Interledger Protocol (ILP). The ILP is a decentralized application that allows users to purchase any currency, whether fiat or crypto, and transfer it to any blockchain or payment system.

The system is estimated to go live in 2020 . With this system, people can purchase cryptocurrencies using their fiat currency without needing to login to a centralized exchange. More importantly, users can trade cryptocurrencies among themselves without a third-party service provider to facilitate the process.

The implementation of the ILP is bullish. That’s because the app significantly reduces the degree of difficulty to purchase and transfer cryptocurrencies. More importantly, it can ignite widespread adoption. Digital coins would not only be used for investments/speculation but also in day-to-day activities such as cross-border transactions and merchant payments.

Bottom Line

A mega bullish event for one cryptocurrency can be beneficial to all cryptocurrencies. The event will not only attract new market participants but it will also boost the value of other coins as capital is rotated from one crypto token to the next. More importantly, there are certain developments that can help spark adoption. The more people buying cryptocurrencies, the better for rising prices.

Disclaimer: The above should not be taken as investment advice.