3 High-Flying Cannabis Stocks with Potential Gains Yet to Be Unleashed

The surge in cannabis stocks has been deemed by some as the new gold rush. Canopy Growth, Cronos, and Kushco Holdings are likely to explode in 2019. | Source: Shutterstock

By CCN.com: Over the last 12 months, there has been tremendous hype on cannabis stocks. The widespread legalization in some states in the U.S. and all of Canada caused many stocks related to the pot industry to skyrocket. The surge has been deemed by some as the new gold rush . If you feel like you got left behind, don’t worry.

Some cannabis stocks have corrected over the last few months, and they’re ready to be bought on dips. Here are three cannabis stocks that can go higher this year.

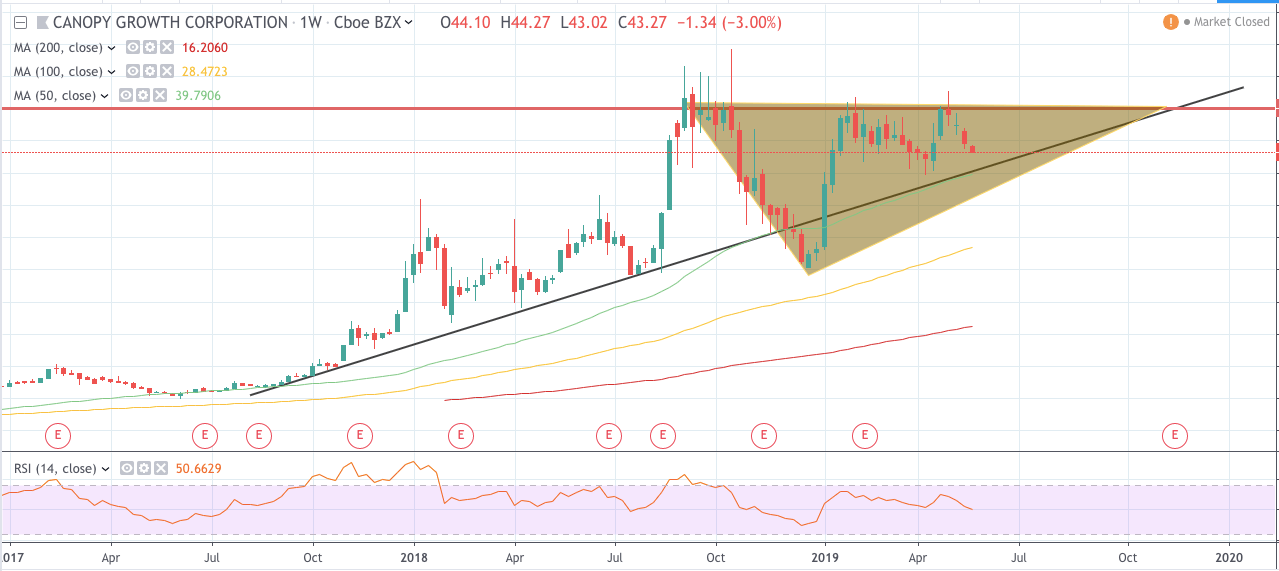

No. 1 Cannabis Stock – Canopy Growth Corporation (CGC)

Canopy Growth Corporation envisions to be the No. 1 marijuana company in the world. Looks like they are on the right track, as the company’s stock is on a multi-year uptrend from a macro perspective. The stock is currently correcting, but it is painting a giant continuation pattern on the weekly chart.

A quick look at the weekly chart shows two bullish signals. First, CGC has managed to keep its diagonal support intact. This means that the market remains bullish for the long-term.

Second, the stock is printing a large ascending triangle pattern. This is a bullish continuation structure supporting our bias that CGC is in an uptrend. If you’re looking to buy this stock, enter the market after it takes out resistance of $50. The target price is $75.

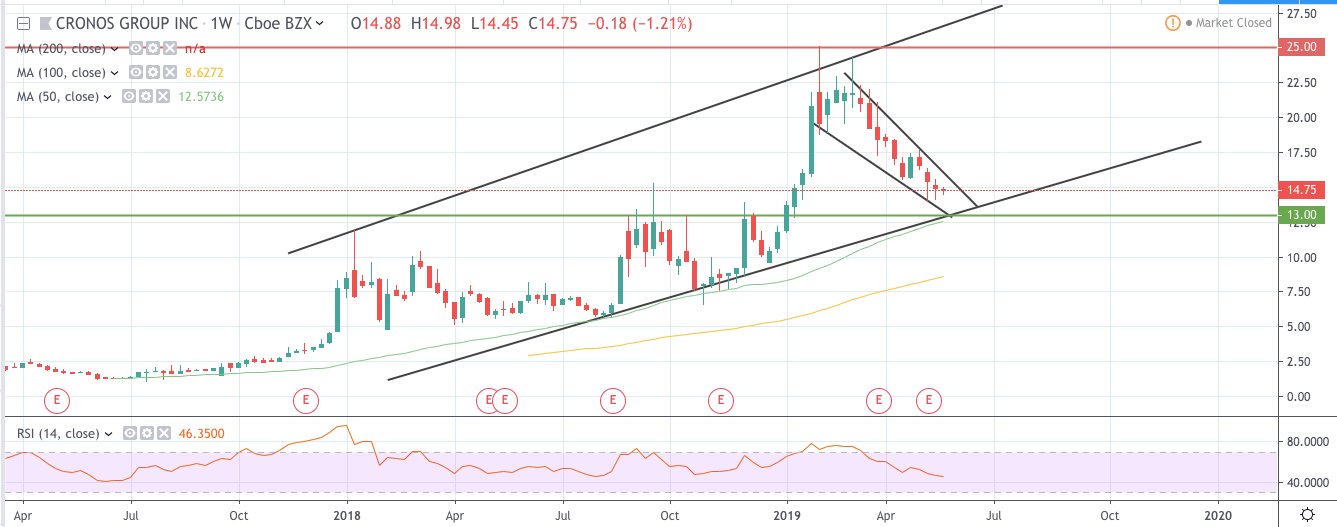

No. 2 Cannabis Stock – Cronos Group Incorporated (CRON)

Cronos Group helps to advance the cannabis industry by promoting marijuana research, technology, and product development. Although its stock is backpedaling, it is still in a long-term uptrend.

The weekly chart tells us that CRON is forming a falling wedge within a large ascending channel. This suggests that for the short-term, the market is bearish. But the long-term uptrend is still intact.

If you’re looking to buy CRON, wait for it to drop as close to $13 as possible. There are three supports converging at that price level: the horizontal support, the diagonal support, and the 50 moving average which is acting as support.

Should bulls successfully defend $13, the target price is $25.

No. 3 Cannabis Stock – Kushco Holdings Incorporated (KSHB)

Kushco Holdings considers itself as the premier provider of ancillary products for the cannabis industry. For now, its stock is in sideways consolidation.

For almost a year and a half now, KSHB has been range trading between range low of $4.20 (no pun intended) and $7. Therefore, the strategy is simple: buy the support and sell the resistance. Pick up shares as close to $4.20 as possible and ride KSHB all the way up to $7.

Should bulls breach $7, we can see the stock going as high as $10.

Bottom Line

The widespread correction in the cannabis industry has driven many investors to look for greener pastures. Nevertheless, technical signals tell us that the industry is still lit. CGC, CRON, and KSHB are prime examples of pot stocks that can go higher.