3 Best Cryptos to Buy in 2019 Before They Explode with Massive Gains

The crypto rally isn't all about bitcoin. | Source: Shutterstock

By CCN.com: With numerous bullish breakouts on the longer timeframe, the crypto bull market is growing stronger by the day.

We’re not just talking about bitcoin. On the contrary, the disbelief rally of the king of cryptocurrencies may be on its last legs. This gives other large-cap cryptos the opportunity to step into the limelight. We did our research and discovered that TRON, Stellar, and Ethereum Classic offer some of the best setups that can generate massive gains in a short period of time.

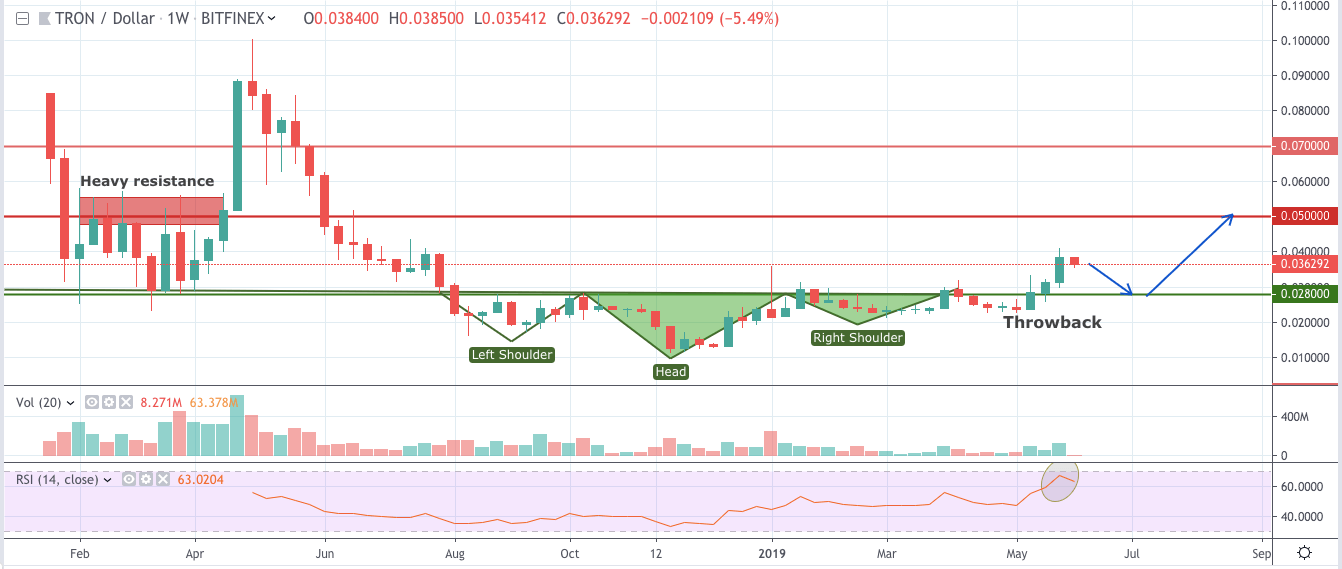

TRON Looks Incredibly Strong from the Macro Perspective

TRON’s mighty rally over the last few weeks has officially ended its 12-month long downtrend. The cryptocurrency demolished $0.028 resistance in May 2019. This triggered the breakout from a large inverse head-and-shoulders pattern on the weekly chart. The structure has a very high success rate . In other words, most inverse head-and-shoulders breakouts result in massive trend reversals.

Currently, TRON’s breakout rally appears to be fading. That makes sense considering that the weekly RSI is close to overbought conditions. So if you’re interested in opening a fresh long, wait for the cryptocurrency to retest $0.028 as support. If bulls hold that level, TRON will target $0.050.

Take note: $0.050 is a heavy resistance but if TRON punches through it, $0.070 becomes an easy target.

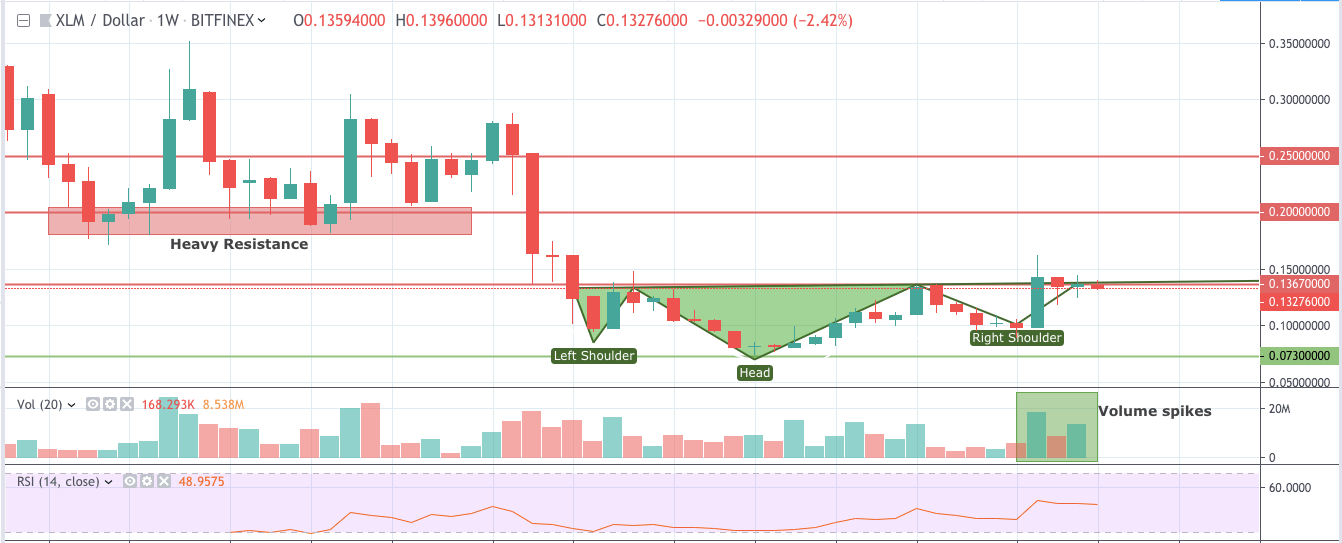

Stellar Closely Trails TRON

Following the footsteps of TRON is Stellar. The market is also painting a large inverse head-and-shoulders pattern on the daily chart. While it has yet to break out of the pattern, it is threatening to do so soon.

Watch out for the breach of $0.1367 resistance. We expect it to happen in the next few days as volume starts to build. A move above this level will likely catapult the crypto to heavy resistance of $0.20. At that point, stellar will likely consolidate for some time before it can take out $0.20. Thus, it is possible for the cryptocurrency to target $0.25 before the year ends.

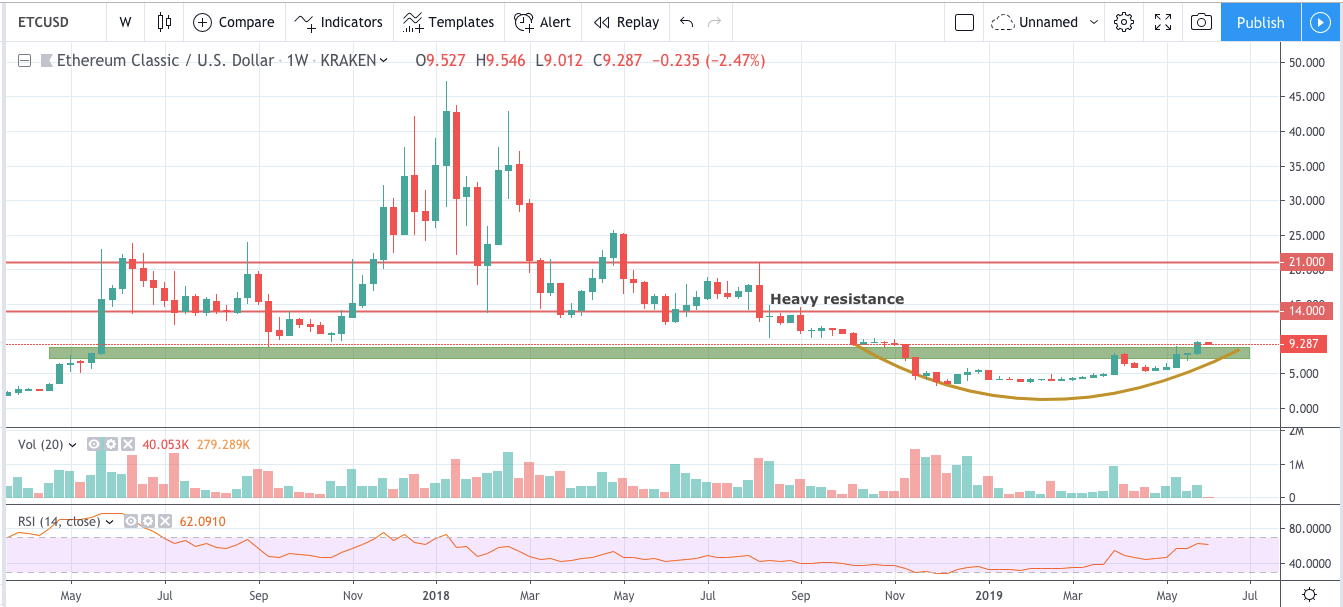

Ethereum Classic Gearing up for Its Own Disbelief Rally

Keep a close eye on Ethereum Classic. The crypto has been in a downtrend for over a year and a half. The bear winter brought the market from an all-time high of $47.296 in January 2018 down to $3.213 in December 2018. That’s a plummet of over 93 percent in twelve months.

But no more, as bulls have decided enough is enough. They are ready to take charge of the market and redeem themselves.

Bulls closed the month of May 2019 above a resistance level of $8.75 with a rounding bottom breakout. This was a crucial move as that price is a key level to break on the longer timeframe.

As long as Ethereum Classic trades above that level, the logical target is $14. We expect bears to put up a fight and protect their territory at $14. However, a breach above this level will likely take the market to as high as $21 which is our year-end target for the cryptocurrency.

Bottom Line

Large-cap cryptocurrencies such as TRON, Stellar, and Ethereum Classic are starting to show signs of strength. All three cryptocurrencies appear to be in the early stages of their respective uptrend from the macro perspective. Hence, buying on dips offers you the chance to maximize gains, especially if you’re a long-term investor. If you stick to the trade plan that we’ve presented, you are very likely to enjoy massive gains before the year ends.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com. This article is intended for informational purposes only and should not be considered investment advice.