$136 Million in Missing Crypto From QuadrigaCX Could be Gone Forever: WSJ

An analyst h as claimed that the 'missing' funds from embattled Canadian crypto exchange QuadrigaCX may not be stuck in a cold wallet but missing altogether. | Source: Shutterstock

Canada’s largest digital asset exchange QuadrigaCX has claimed to have lost more than $136 million worth of crypto in cold wallets controlled by its CEO Gerald Cotten.

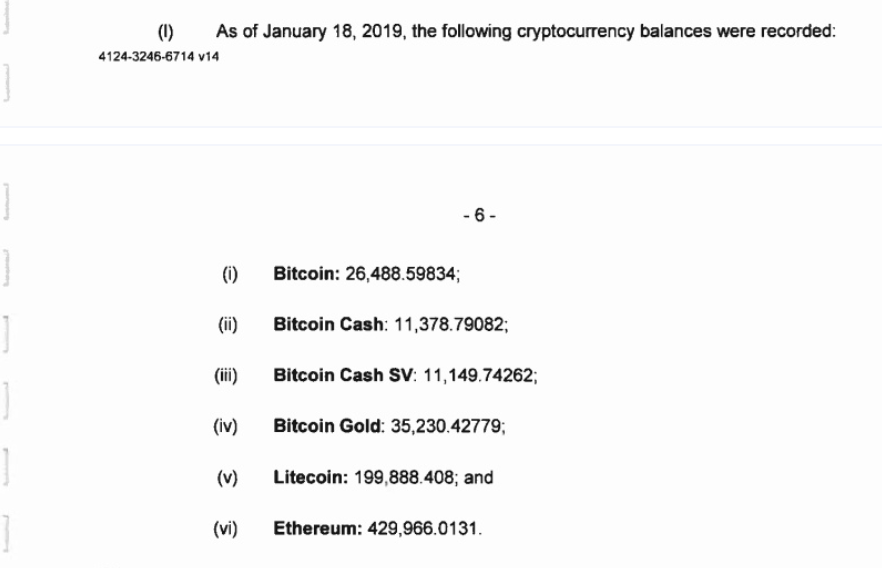

In an official affidavit filed with the Nova Scotia Supreme Court by Jennifer Robertson, the widow of Cotten, Robertson claimed Cotten passed away in India with the sole control over user funds.

On February 6, at a court hearing, the exchange confirmed that it has lost 250 million CAD, roughly $188 million in user funds, mostly in crypto and partially in fiat, which the exchange still cannot access.

According to CBC , a Canadian mainstream media outlet, 116,000 users of QuadrigaCX are currently left without their funds.

Controversy Intensifies, Missing Crypto May Be Gone, Not Locked

On Thursday, The Wall Street Journal reported that there exists a possibility the missing cryptocurrencies from QuadrigaCX may be missing, not locked in cold wallets.

Several researchers including James Edwards, an editor at Zerononcense, suggested that there is no evidence to prove the existence of QuadrigaCX’s cold wallets.

Most of the main wallets, those identified to date, are said to have processed the types of transactions that are normally not settled through cold wallets.

Cryptocurrency exchanges often go extra lengths to secure their cold wallets, which are offline wallets containing digital assets. To ensure the majority of user funds are out of the reach of hackers, exchange utilizes cold wallets to store most of its funds.

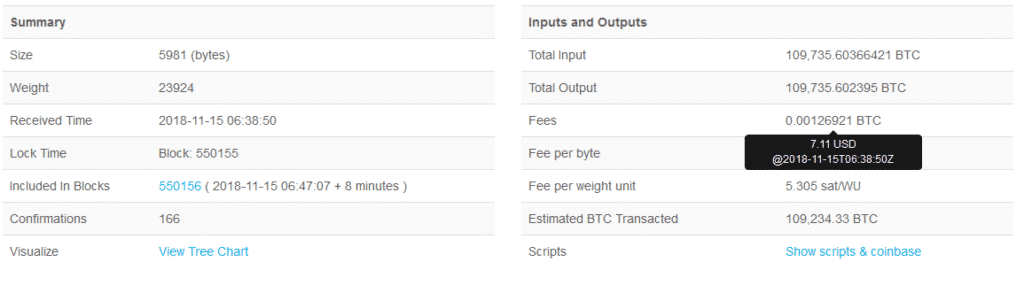

When a cold wallet transaction is initiated, as seen in one transaction initiated by Binance in November 2018, the transaction typically involves many millions of dollars.

However, most transactions initiated by the main wallets of QuadrigaCX were small in size and were processed at a rate in which it is difficult to justify they were cold wallets.

According to WSJ, researcher James Edwards obtained 50 accounts of QuadrigaCX clients and carried out an analysis of the addresses. Edwards could not link any of the addresses to the cold wallet QuadrigaCX is referring to.

The report published by Edwards read:

Based on the analysis of dozens of aggregated wallet addresses and transaction IDs for bitcoin withdrawals and deposits on the exchange, there is no evidence that a cold wallet for QuadrigaCX is currently in existence.

Speaking to CCN.com, MyCrypto CEO Taylor Monahan also suggested that there may be no cold wallets in existence for the Ethereum holdings.

While Monahan emphasized that one main wallet holding 500,000 transactions is yet to be analyzed, it is highly unlikely that it is a cold wallet.

“Oh, and just in case you weren’t shaking your head enough, don’t forget that Quadriga ran an exchange with KYC. They have a pile of user’s KYC data. They could turn around and open an exchange account with any of that KYC data to move money,” she added.

No Report Can be Definitively Proven But Suspicions Remain

As David Jevans, the CEO of CipherTrace, said , it is not possible to definitively prove any of the claims against QuadrigaCX and its lack of cold wallets is accurate.

“In my opinion, that’s an impossibility to determine,” Jevans said, referring to the reports that have been published since the QuadrigaCX case went public.

But, if funds in the supposedly lost wallets of QuadrigaCX, which are traceable on the public blockchain networks of Bitcoin, Ethereum, and other major crypto assets, then the story of QuadrigaCX could quickly fall apart.

For now, both investors and the cryptocurrency community are waiting on a thorough investigation to be completed in the QuadrigaCX situation.

The claims of researchers in the cryptocurrency sector are that if no cold wallets or reserves of the exchange cannot be identified, how would it be possible, whether it is the exchange or third-party firms to even attempt to recover millions of dollars in user funds?