$1 Trillion Stock Market Massacre Risks Igniting Global Recession

The Dow careened more than 720 points lower as Wall Street scrambled to digest China's devastating trade war escalations. | Source: AP Photo / Mark Lennihan

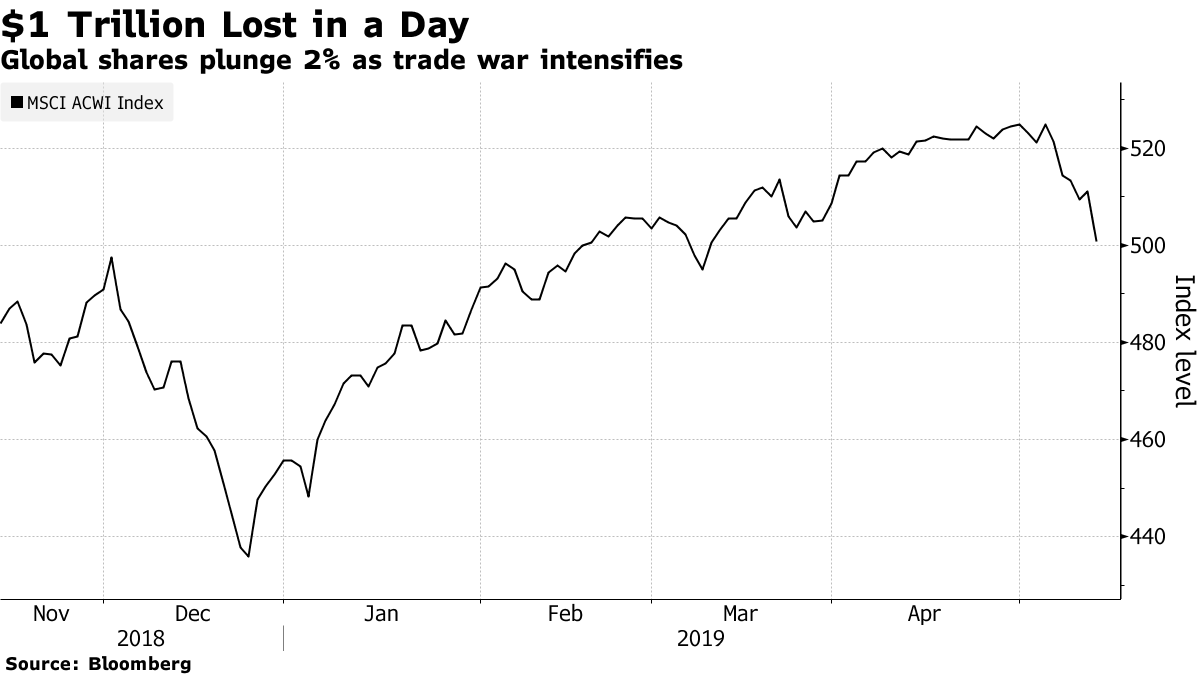

By CCN.com: Monday’s devastating stock market massacre wiped a staggering $1 trillion from equities valuations as the U.S.-China relations escalated into a full-blown trade war. American farmers, among the worst hit by the trade war, are saying they feel like “it can’t get worse,” but economists fear a global recession is next.

Global Recession Will Bite if Trade War Escalates

In a note to clients on Friday, Bank of America Merrill Lynch economists wrote :

“A trade war, with across-the-board tariffs on US-China trade, would push the global economy towards recession.”

This is the worst case scenario most economists fear from a full-fledged, Cold War-like trade war between the U.S. and China, in which the U.S. levies tariffs on all Chinese goods and the Chinese government retaliates again in kind.

In a note Monday, Morgan Stanley’s chief U.S. equity strategist, Michael Wilson, said the massive tax burden of new tariffs would create cost pressures that U.S. companies won’t be able to offset. The Wall Street analyst fears this will lead to a recession:

“Given other cost pressures and stubbornly low inflation, we are unconvinced that companies will generally be able to fully offset tariff costs through raising prices or through cost efficiencies elsewhere, meaning tariffs will press on margins. In the case of 25% tariffs on all of China’s exports to the US, we are inclined to think this has the potential to tip the US economy into recession given the cost issues companies are already dealing with.”

The center-right Tax Foundation says Friday’s tariff increases raised taxes on American businesses by $72 billion. The foundation estimates any further escalation in the trade war threatens to wipe out half of the long-term impact of the Tax Cuts and Jobs Act, and that more than 500,000 American jobs could disappear.

Even top Trump economic advisor Larry Kudlow admitted in a widely publicized interview with Chris Wallace on Fox News Sunday that “both sides will suffer” as a result of the latest escalation in Trump’s trade war.

Warren Buffett: Stock Market Sell-Off Is ‘Rational’

This latest escalation in Donald Trump’s trade war cost investors a trillion dollars worth of global stock values in one day.

A week ago, legendary stock investor Warren Buffett said it’s “rational ” for investors to unload stocks in light of recent tariff increases and the threat of even more. Donald Trump is now threatening to levy tariffs on the $300 billion of remaining Chinese imports that he hasn’t taxed yet.

Buffett, who says the two world powers are playing a “dangerous game,” warns a full-blown trade war like this would be very bad for the entire world economy:

“If we actually have a trade war, it would be bad for the whole world, and could be very bad, depending on the extent of the war.”