Surging Repo Market Rates May Signal Another 2008 Economic Meltdown

The Federal Reserve has had an active week. In addition to lowering interest rates, the New York Fed has been pumping billions into the financial system to shore up liquidity constraints. | Image: REUTERS/Brendan McDermid

The repo market has been grabbing the headlines lately. That’s because this little-known but vital aspect of the U.S. financial system is under duress. The situation has forced the U.S. Federal Reserve to step in for the first time since the global financial crisis of 2008.

Many had hoped that the intervention of the Fed would stop the bleeding. However, it appears that the situation keeps getting worse and there’s no end in sight.

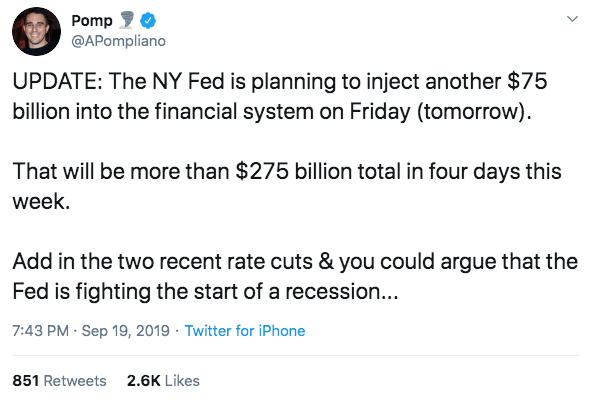

According to Anthony Pompliano, the Fed would throw another $75 billion into the repo market today, bringing the size of the weeklong operation to over $275 billion. In less than a week, the Fed injected 34.4% of the $800 billion that it printed during the 2008 bailout. This is why you should start paying attention to the repo market.

What Is the Repo Market?

The repo market – short for repurchase agreement – is a $2.2 trillion marketplace . Many retail investors are not aware that such a bourse exists. However, it is an essential component of the U.S. financial system.

In the repo market, financial institutions such as hedge funds and investment banks borrow cheap money from large investors such as mutual banks to fund their operations. The borrower (hedge fund) or the dealer sells securities such as the U.S. Treasury bills as a form of collateral for the short-term loan. The counterparty or the buyer (mutual banks) takes the collateral and earns a small interest once the borrower repurchases the security.

In short, the repo market is the biggest pawnshop in the world.

For example, hedge funds may borrow money from mutual banks to finance leveraged investments. When trading in leverage, every point that moves in your favor counts. Thus if you can borrow cheap money with an interest rate of less than 2% and you gain more than 3% on your leveraged trade, you earn profits plus the capacity to repurchase the security that you pawned.

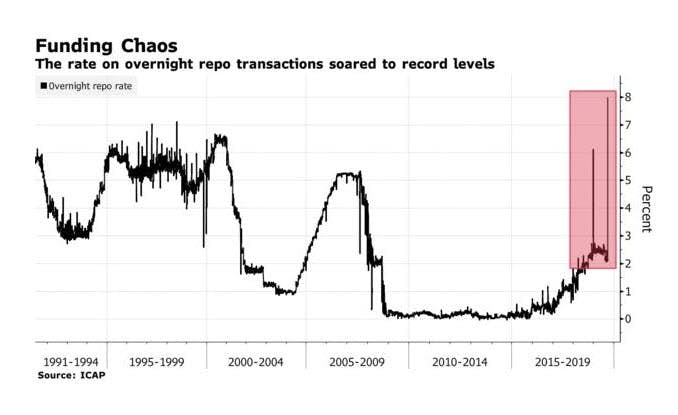

That’s why when the repo market interest rates surged to above 6% earlier this week; many traders who relied on cheap money to enter leveraged trades were crushed.

What Caused Interest Rates to Spike in the Repo Market?

There are two factors that drove repo rates to surge. First, the money supply dried up because corporations had to withdraw funds to settle quarterly tax bills. At the same time, those who bought Uncle Sam’s Treasury notes and bonds the week prior to the tune of $78 billion had to pay up.

But it appears that the most important variable that’s causing rates to skyrocket is the significant reduction of bank reserves held at the Fed. According to Reuters , reserves at the Fed last amounted to $1.47 trillion which is down by close to 50% from its peak of $2.8 trillion five years ago.

This liquidity crunch is forcing the Fed to print billions of dollars to meet demands for short-term loans and keep rates under control.

Why Should You Pay Attention to Repo Rates?

For now, repo rates are tamed thanks to the injection of fresh capital. Alex Kruger exclusively spoke to CCN.com regarding the Fed’s latest moves. The economist said,

It is the appropriate measure to reduce short-term liquidity issues.

However, it looks like the liquidity problem is lasting longer than expected. Zerohedge reported that the repo operation on Thursday was oversubscribed, meaning that there was more demand than supply. This was an indication that the funding crisis is far from over.

Therefore, the Fed must come up with a solution other than pumping money into the system. So far, investors are left in the dark. Without a long-term fix, expect repo rates to remain unstable. This is bad news for retail investors and for the overall economy.

First, the last time the Fed had to intervene in the repo market was back in the 2007-2008 global financial crisis. During that time, liquidity dissipated as money lenders doubted the quality of the collaterals provided by borrowers. As a result, investment banks such as Lehman Brothers and Bear Sterns became insolvent.

Panic ensued and lenders demanded cash from borrowers. This ignited one fire sale after another as borrowers dumped their securities to pay for their loans. This spilled over to the stock market, and the rest is history.

Currently, the Fed is keeping the repo market calm with fresh capital injection. However, people are already feeling jittery because the rate keeps spiking in spite of the intervention. It appears that something is fundamentally wrong. If it is not immediately found and addressed, we may see a repeat of the 2008 global financial crisis.