Why The SEC Should Approve The Winklevoss Bitcoin ETF

When the Securities and Exchange Commission (SEC) recently asked for public comment on the Winklevoss Bitcoin ETF, Bloomberg analyst Eric Balchunas didn’t waste any time. Balchunas, who focuses on exchange-traded funds, thinks the case for bitcoin, which has returned 610% since the ETF was filed in July 2013, is strong.

The commission has taken a lot of time to decide on whether or not to approve the first bitcoin ETF, with concerns about bitcoin’s stability and security. Balchunas thinks the reasons favoring approval outweigh these concerns, which he outlined in a recent Bloomberg opinion piece .

What Options Are There?

By not approving the ETF, bitcoin investors will have only one option for a bitcoin investment tool, the Bitcoin Investment Trust (GBTC). The spread between the GBTC price and bitcoin’s value is between 50% and 100%. The average bid/ask spread is 1.5%, and the expense ratio is 2%.

The ETF’s creation/redemption process, by contrast, keeps prices and net asset values closer through arbitrage, Balchunas noted. A bitcoin ETF would trade at a price much less than GBTC’s and would improve over time with more professional management.

ETFs also have a good record of penetrating new investment areas, a feature that has generally benefited investors.

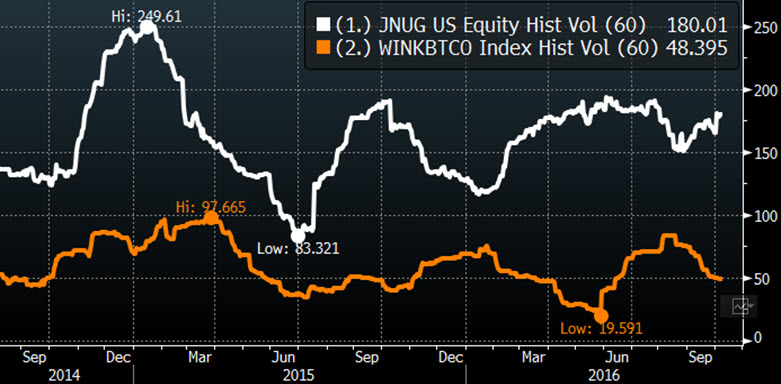

Compared to some other popular funds the SEC has approved, an ETF offers a more secure and less volatile option. About 60 ETFs are more volatile than bitcoin, such as the Direxion Daily Junior Gold Miners Index Bull 3x Shares, which features 60-day volatility of 18% compared to bitcoin’s 49%.

Is Security An Issue?

As for security, bitcoin fares no worse than exchange-traded notes, which carry more than $25 billion in assets. Should an insurer for these unsecured debt obligations go bankrupt, the investor stands to lose everything.

A wolf in sheep’s clothing? The label hardly applies to the Winklevoss ETF, given the obviousness of bitcoin’s risks. The United States Oil (USO) ETF, on the other hand, is subject to 32% annual futures “roll” costs, something many people don’t know.

Also read: SEC receptive to Winklevoss bitcoin trust

Consider The Source

Nor can Balchunas discount the Winklevoss’ twins’ patience, resolve and dedication to launching the ETF. Clearly the twins are not fly-by-nighters. They have invested a lot in the ETF process and have made improvements in the past three years. They have chosen the ETF route over an OTC product, which would have launched faster.

No ETF filing has drawn such media scrutiny, Balchunas noted, so any issues with the offering will be front and center.

Featured image from Shutterstock.