Crypto Whale’s $200 Million Short Triggers 8.5% Bitcoin Price Plunge

Bitcoin is leading the corrective retreat of the crypto market following the weekend. | Source: Shutterstock

On June 30, according to a cryptocurrency trader, a single investor on Bitfinex placed a 20,000 BTC short order, betting more than $200 million that the bitcoin price would go down in the near term.

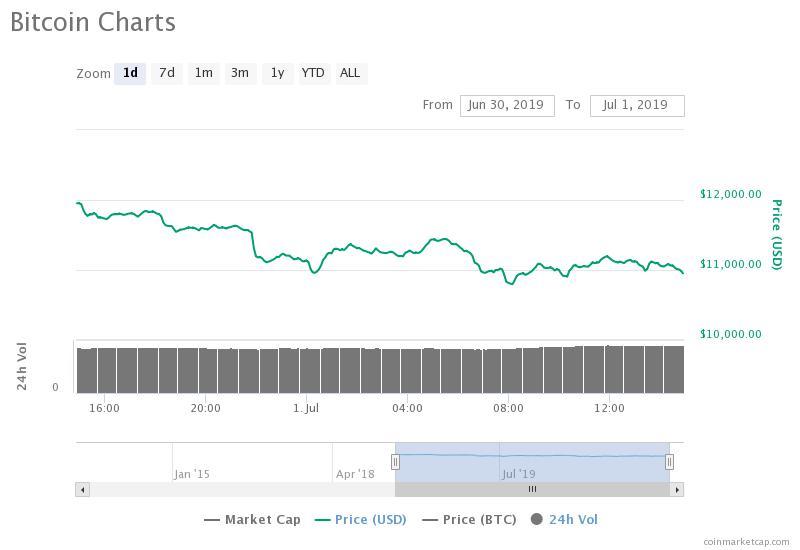

Overnight, the bitcoin price fell from $11,900 to $10,765 as the valuation of the crypto market dropped by well over $20 billion within a span of hours.

Unexpected drop, is a swift recovery for bitcoin possible?

Josh Rager, a cryptocurrency technical analyst, said that if the bitcoin price closes below $11,500, a sharp drop below the $10,000 mark is a possibility.

“Bitcoin has pulled back near 26% (similar to May ’19) before it consolidated for weeks & continued up It’s not often we get two 26%+ pullbacks so close together in bull market So it’s a real buying opportunity if BTC closes below $11,500 tonight & we retest the $9k/$10ks,” he said .

The minor correction of bitcoin led many major crypto assets to decline in value against both BTC and USD.

Even litecoin, which recorded a five percent increase against USD on Sunday fell by more than five percent. Ethereum, Bitcoin Cash, EOS, Binance Coin, and other alternative crypto assets have fallen by more than five percent on average.

The abrupt 8.5 percent drop of bitcoin in the last 24 hours was primarily caused by technical factors; an investor placed a large short contract which then led many retail investors to panic sell and bring down the market.

However, in the medium term, there still exist bullish fundamental catalysts that may improve the sentiment around the market.

With trading venues in the likes of Fidelity and Bakkt opening in the latter half of 2019 and retail interest gradually rising, possibly fueled by the increase of institutional interest, analysts foresee a generally positive trend for the dominant crypto asset.

Global markets analyst Alex Krüger said :

Fundamentally, many bullish catalysts still ahead: Fidelity, Bakkt, Ameritrade, Etrade. Bakkt would begin testing its futures Jul/22. Retail interest is steadily climbing, and so is institutional interest, which has been piqued due to BTC’s performance and macro narratives.

In the short term, due to the unforeseen decline in the bitcoin price, traders remain cautious about the trend of the asset.

Some positives in the market

One trader with an online alias “Satoshi Flipper” noted that alternative crypto assets have started to decouple from bitcoin, which typically does not occur during the bear market.

In an extended correction, alternative crypto assets tend to follow the trend of bitcoin, demonstrating intensified movements to both the downside and upside.

With the market showing decoupling and the monthly trend of bitcoin still indicating a positive medium-term trend, traders see optimism in the current market.

Rager said :

“Weekly close looks ugly, you’ll likely see this shooting star type of doji all over CT. Which typically is a signal for reversal & we could see a couple of down weeks for Bitcoin. But be happy as that would mean prime buying opportunities ahead.”

In the past month, the bitcoin price has spiked nearly 30 percent against USD inclusive of yesterday’s 8.5 percent drop.

Hence, although a sudden pullback in the magnitude of 8.5 percent was not generally anticipated by investors, some believe that pullbacks in a bull market can be healthy to stabilize the market and strengthen its foundation.