BitPay Crashes Bitcoin Price? Why The Price is Falling

2014 will be the year flooded with the tears of speculators. Falling prices this past year have lead to many theories regarding price. One of the most recent is a rehash of the very old – Any service like BitPay crashes the bitcoin price.

Founded in 2011, BitPay is the leading payment service provider (PSP) specializing in the peer-to-peer virtual currency Bitcoin. Over the past four years, they have provided merchants the means of accepting bitcoins without the risk of price volatility. BitPay interfaces with merchants like a credit card. From the merchant’s perspective, it’s just another form of payment that deposits cash in their accounts. Each day, BitPay processes over $1m in transactions.

Their slogan “Charge $1, get $1” attracts thousands of merchants. Some, seeking an increase in profit margins, attracted by low processing fees. Others, seeking new revenue streams, just want to accept a new form of payment. Regardless, BitPay has become more than a middleman and the top PSP at market because they offer services businesses find attractive.

Speculators claim services like BitPay crash the bitcoin price because not all merchants using BitPay keep any bitcoins . Instead, merchants accept payments and immediately cash out their coins to fiat currencies, driving down the price of a bitcoin.

Historically, BitPay has used Black Friday as a metric recognizing Bitcoin’s movement towards mainstream adoption. In 2013, BitPay processed over $6m in transactions in a single day of post-Thanksgiving shopping. As those numbers increase, BitPay becomes more cryptic in the information they reveal.

Last December, BitPay made the announcement on their blog. Bitcoin usage is up, way up. BitPay merchants Gyft and Newegg set records for the number of bitcoin sales last Black Friday. The precious metals dealer, Amagi Metals saw the highest volume of orders for one day. Overall, the value of a single purchase grew 143% over the previous Black Friday.

All these things signal growth. So why do speculators whisper about how services BitPay crashes the bitcoin price? In short, they look at the short-term effect of large vendors accepting bitcoins but they fail to look at the bigger picture.

BitPay Crashes Bitcoin Price? Nah, Insufficient Volume

Volume matters because the speculation claims that BitPay services provide an easy means to move the value out of the Bitcoin economy in exchange for fiat. Two years ago, holders could not spend their coins so easily. Now that merchant adoption has hit all-time highs it has never been easier to spend your bitcoins. It’s just simple economics after that. Demand is the same, but the supply has increased – the price crashes.

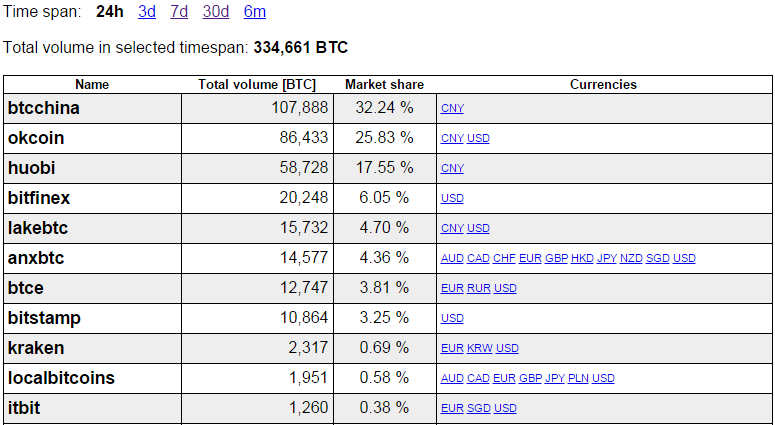

BitPay claims to process over $1m of bitcoin transactions daily. Data provided by Bitcoinity can help gauge where BitPay lies among exchanges.

To process $1m in transactions BitPay must process 3,334 BTC a day. At a price of $300 a bitcoin, their volume is just above Kraken or ~1%. Furthermore, BitPay announced 4,400 of their 44,000 merchants hold bitcoin exclusively. 18,000 more keep a mix of fiat and bitcoin while the remaining 22,000 cash out directly to fiat.

Hypothetically, let’s assume 80% of all bitcoins spent through BitPay get sold immediately. The merchants reinvest the profits back into fiat-based services instead of Bitcoin. The value has fully left the Bitcoin economy. Well, that’s still only 2,600 Bitcoin, or $760,000 fiat, each day.

The price of a bitcoin is falling because more holders are willing to sell bitcoins than buyers are willing to pay. Sorry if that was not the giant surprise, conspiracy, or thriller you expected.

By virtue of mining, Bitcoin is ‘printing’ 3600 new coins each day. Very little evidence exists to support the claim that services like BitPay crash the bitcoin price. The same could be said of miners immediately cashing out new coins to pay the overhead and costs of their equipment.

The price of a bitcoin is falling because more holders are willing to sell bitcoins than buyers are willing to pay. Sorry, if that was not the giant surprise, conspiracy, or thriller you expected. Sometimes it’s just the month after the holiday season and everyone already spent their money on, gasp, the holidays.

BitPay Good, Fiat Evil

BitPay is not the cause of the price crash. Services like BitPay are a contributor to Bitcoin’s price, not a detractor. During early adoption phases, it’s typical for a business to operate at a loss. Venture capital funding keeps the organization running while they build up a base of users. BitPay is no different. They are building a bridge to greater adoption and the future where 22,000 merchants cashing out to fiat will sound absurd.

Also Read: Ancient Viruses Hacked Human Brains

What are your comments?