Bitcoin Begins The End of 100 Years of Slavery

In 1907, the American banking system failed. To save the system, the US government sold control of the economy to a group of private bankers.

In 1907, the American banking system failed. To save the system, the US government sold control of the economy to a group of private bankers.

The United States Federal Reserve is a private corporation. That sentence is not a contradiction. The system is a public/private hybrid. Signed into law by Woodrow Wilson in 1913, Congress officially recognizes the private bank, known as The Federal Reserve, as the central bank that controls the American banking system. Commissioned to fulfill three objectives: Maximizing Employment; Stabilizing Prices; and Moderate Long-Term Interest Rates. It has since expanded in power greatly. Today, it controls the US monetary policy and is curator of US Dollar. It supervises and regulates banking institutions, and provides banking services the US and foreign governments.

They’re the Masters of the Universe.

United States Imperialism is a side effect of dollar hegemony. US power is not tied to its military, the number of bombs it possesses, its democratic system, unions or a dream. Real power is the US Dollar as a world reserve currency. For as long a nation or people use dollars the Federal Reserve may siphon their wealth at will.

The Long Con; to Hustle a Nation

Central Banking is just the modern-day term for a process that converts money into power. The Federal Reserve is not the Illuminati. This article isn’t meant as conspiracy or to speculate on politics. I’m not wearing a tinfoil hat right now (but sometimes…). There is history and story, to how we got here. The history of the Fed is as surreptitious as its naming.

The Federal Reserve that we know is the third iteration of central banking in the United States. The First Bank of the United States chartered in 1791. The original US pocket-politician, Alexander Hamilton championed an expansion of federal power in fiscal and monetary realms. Located in Philadelphia Pennsylvania, Thomas Jefferson, James Madison, and George Clinton opposed The First Bank of the United States. After a twenty-year tenure, the vote to renew its charter failed to pass Congress – resulting in a tie that Clinton broke.

Alexander Hamilton was a corporate stooge. Rather, Hamilton was a corporate stooge looking for a corporation. He found his home with the US government. Orphaned at the age of 11, private charity sent Hamilton to college. He repaid their efforts promoting a strong central government, nationalism and provided the foundation for Congress to accrue a national debt. Effectively, Hamilton’s legacy is the sludge coating the heart of every modern politician and lobbyist.

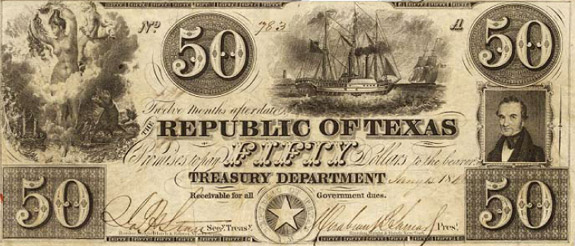

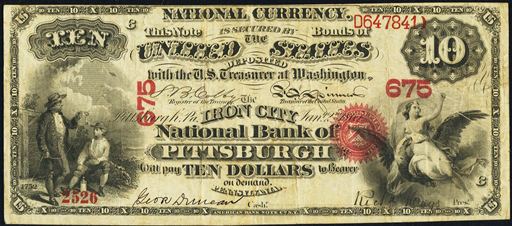

When a central bank wasn’t around issuing a federally mandated currency, private banks, states and organizations issued their currency. Individuals even had the ability to create their currencies. Like any other commodity, currency competed for consumers. If I don’t think your Texas Dollar is worth as much as my Pennsylvania Pound, I don’t have to accept it. It sounds like chaos, but its better than the alternative. In the least, this republic system of currency forced individual states and organizations to compete with each other. Nationalization of banks under the Hamiltonian System united them together against… us.

Also Read: Brian Sovryn Says ‘Altcoins Are Bullshit,’ Provides Weak Argument

After the war of 1812 the American economy was suffering. Seen as the second war for independence, British forces pushed as far was Washington D.C. and burned the White House. In 1816, five years after the dissolution of the First National Bank of the United States, the Second National Bank of the United States was chartered by James Madison. Conspiracy would be saying, a year after dissolving the national bank whose interests were largely held by bankers overseas, Britain extends the Napoleonic Wars to the United States to disrupt the economy. As I said, no tinfoil hats here.

The Bigoted American Bad Ass: Andrew Jackson

The seventh president of the United States was captured and tortured by British soldiers when he was thirteen. After helping liberate the US, he co-founded Tennessee, won election to the US Senate and his followers eventually founded the Democratic Party. He led and illustrious military career, pushed the Indians from their native lands during America’s western expansion and owned hundreds of slaves. He killed a man in a duel defending his wife’s honor, carrying a bullet from the encounter in his chest until the day he died – many years later.

The seventh president of the United States was captured and tortured by British soldiers when he was thirteen. After helping liberate the US, he co-founded Tennessee, won election to the US Senate and his followers eventually founded the Democratic Party. He led and illustrious military career, pushed the Indians from their native lands during America’s western expansion and owned hundreds of slaves. He killed a man in a duel defending his wife’s honor, carrying a bullet from the encounter in his chest until the day he died – many years later.

Murray Rothbard is credited with the saying, “Hatred is my muse”, but Jackson’s hard boiled, cold-hearted hatred of central banking makes Rothbard’s sentiment trivial. Jackson supported the central government having effective powers, but he believed the central bank catered to the interests of the wealthy and foreign investors. His bid for the presidency was fueled by the righteous vitriol towards backroom politics that his competitors used to defeat him in his first presidential election. When the Second Bank of the United States re-submitted its charter to Congress in 1832, it passed Congress. Jackson vetoed the bill.

This guy wasn’t a paragon of the human spirit. He was vindictive, spiteful and clearly a bigot. Even this asshole wasn’t willing to subject an entire nation of people to a national bank. He was a brutal man for brutal times. He was noted for fits of rage , terrifying his opponents. He stood 6′ 1″ with bed head red hair, deep blue eyes, and suffered chronic pain. The bullet lodged in his chest subjected him to violent fits of coughing up blood and made his body shake. Some claim his final words on his death bed were “I killed the bank.” I’ve never found any evidence that’s true – or that it appears on his tombstone. Perhaps it’s a misquote. He did say, “The bank, Mr. Van Buren, is trying to kill me, but I will kill it.” as quoted in The Autobiography of Martin Van Buren.

In retaliation, president of the Second Bank Nicholas Biddle, created a financial crisis. Known as The Bank War, it was the struggle between Jacksonian Democrats and nationalist Republicans to decide the fate of the central bank. Jackson, fearing Biddle would retaliate against his efforts, decentralized federal deposits from the national bank into multiple private organizations. In 1834, the charter was lost.

The System of Our Slavery

In 1907, the United States was the only financial power in the world without a central bank. The Knickerbocker Trust Company was an American Bank in New York. Chartered in 1884 by friend of J.P. Morgan Frederick Eldrige. In 1907, it used its funds to attempt to corner the copper market – buying up supply and waiting for demand to rise then selling it back… slowly. The attempt failed when unrelated organizations funneled millions of dollars into the market – the free market slapped down the bad actor. When the news became public, a run on the banks was triggered when other banks began rejecting Knickerbocker credit. Wall Street stocks collapsed, falling 50%. Banks began withdrawing reserves from New York banks and reserves failed.

As the power was being siphoned from Wall Street and big banks, Woodrow Wilson was running towards them. Begging them to save the US banking system. He appealed to investor J.P. Morgan to bail out the banks. In exchange for Morgan and his peers injecting their private capital to the banking system the US would form a third central bank – The Federal Reserve.

Morgan borrowed heavily from the UK system of central banking. Nelson Aldrich, a Republican Senator, was sent to Europe. At first, opposing central banking. After viewing Germany’s monetary system, he returned a believer in central banking. Aldrich met with several New York bankers and drafted the banking bill. The Aldrich Plan, as it was known, was opposed in Congress on the basis Aldrich had close ties to J.P. Morgan and John Rockefeller Jr (Aldrich’s Son-In-Law). Progressive Democrats supported the Aldrich plan while conservative Democrats fought for privately owned, decentralized system free from Wall Street.

Woodrow Wilson supported the plan and used the Aldrich Plan as the foundation for the Federal Reserve Act. It passed in 1913.

Also Read: Overstock’s Patrick Byrne: I Was a One-Man Occupy Wall Street

Business was good for the third central bank. After the first World War, governments learned that war was expensive. Initial demands for debt repayments from allied forces after the German surrender amounted the 226 billion gold marks. German countered at 30 billion. In the interim before the decision, Germany had paid 20 billion in gold, commodities, ships, and securities. A great debt was owed to the United States.

At the end of World War 2, European countries were devastated. Their industries, manufacturing and economies had been converted to serve the military. Ironically, 100% employment is unhealthy for the economy when everyone is employed to fight a war. A system was needed to formalize the means through which the debt would be repaid. Before moving forward, the world’s sovereign nations had to agree upon a monetary system. Seven hundred and thirty representatives from forty four Allied nations met in Bretton Woods New Hampshire. The delegates created the Bretton Woods agreement that established the International Monetary Fund and World Bank Group. The system required each nation to adopt a policy of central banking that would maintain and a currency exchange rate backed by gold.

At the time, the US controlled two-thirds of the world’s gold supply. US delegates demanded that debts may only be paid in gold and US Dollars. The Soviet representations refused to ratify the agreement. They claimed the institutions were branches of Wall Street.

Keynesian Science

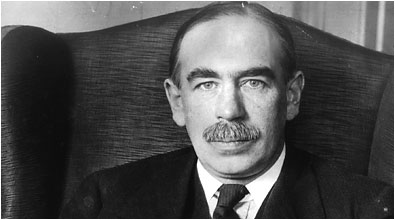

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become “profiteers,” who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction and does it in a manner which not one man in a million is able to diagnose.” – John Maynard Keynes, The Economic Consequences of Peace

John Keynes may not seem like an ally, at first. Keynes wrote the instruction manual for disenfranchising nations of people. He was still brilliant, and the effects of his labors should not turn anyone away from the truth that can be found.

In 1971, Nixon ended the convertibility of dollars into gold. Ending the Bretton Woods system and converting the dollar from a backed money to a system of fiat currency.

If I dig a hole in the Earth and find one ounce of gold, I’m fortunate. Gold has value and applications. It’s sought for jewelry, a finite resource, difficult to find over time and possesses unique properties for applications in science. Instead of selling my fortune at a pawn shop, what if I issued my paper currency?

I could print 1000 pieces of paper and make each one redeemable for 1/1000 of an ounce of gold. I can verify my reserves by showing the gold or depositing with a reputable vendor and receiving documentation backed by their integrity. Recipients who accepted my paper would come to me or my deposit holder, and exchange their paper for a 1/1000 portion of gold.

Paper money solves so many problems. First, gold is heavy and difficult to transport. Second, spending .00001 ounces of gold on a candy is impractical. Also, the process of separating such a small amount would be impractical and likely very expensive. In this example, paper money serves as an abstraction of my spending power and a certificate of redemption to something of tangible value.

Assuming the demand for gold remains consistent, I have complete control over the value of the paper. If, in the previous example, I spend all of my paper money but decide I want to keep the party going and print another 1000 pieces of paper I have created a fractional reserve system. I cannot honor a redemption rate of 1/1000 an ounce of gold per note anymore because 2000 notes are in circulation. Either my system collapses or everyone who is holding my currency just lost half of their savings. It doesn’t end there. I can just keep printing. And printing. If I print another 99,000 papers, the original 1000 papers have lost 100 times their buying power. E.g. Where once one paper dollar bought a candy bar now, 100 must be spent to buy the same candy bar. This is inflation.

The crux of the Federal Reserves power lies in centralization. They have no competitors, and their dominance is assured by the military of the United States government. Having as many countries and people accepting dollars as possible gives the Federal Reserve the ability to extract wealth from those people through printing money, the same way I did in my example. If you want to stop them good luck negotiating with the military industrial complex. Oh yeah, don’t forget, dollars aren’t backed by anything other than the government saying dollars have value.

Betting Our Children’s Future

Taxing your labor is the power of government. Fiat is not the government’s ability to say “One piece of paper buys one candy bar.” Fiat is the ability of the government to reach into your pocket without reprisal. When the government takes on debt, extends credit, or prints money, any fidelity they have hinges on their ability to tax you. Their net worth relies on how much wealth they can extract from the economy while enacting policies that diminish the amount of wealth produced by an economy. It doesn’t matter if they take your property, or the currency you earn, what matters is their ability to extract value. That ability scales to the extent the government is willing to use fear, threats, coercion, or violence.

From 1998 to 2009, Liberty Services exchanged Federal Reserve Notes (dollars) for Liberty Dollars. Liberty Services asserted that the Federal Reserve was unconstitutional. Liberty dollars were a coinage minted in silver and gold. The Federal Government arrested and prosecuted Bernard von NotHaus, the creator. An FBI raid of Liberty Dollar offices seized over two tons of coins, computers, and froze Liberty Dollar bank accounts. NotHaus was charged with “one count of conspiracy to possess and sell coins in resemblance and similitude of coins of a denomination higher than five cents, and silver coins in resemblance of genuine coins of the United States in denominations of five dollars and greater, in violation of 18 U.S.C. § 485, 18 U.S.C. § 486, and 18 U.S.C. § 371; one count of mail fraud in violation of 18 U.S.C. § 1341 and 18 U.S.C. § 2; one count of selling, and possessing with intent to defraud, coins of resemblance and similitude of United States coins in denominations of five cents and higher, in violation of 18 U.S.C. § 485 and 18 U.S.C. § 2; and one count of uttering, passing, and attempting to utter and pass, silver coins in resemblance of genuine U.S. coins in denominations of five dollars or greater, in violation of 18 U.S.C. § 486 and 18 U.S.C. § 2.”

NotHaus was found guilty. He faces 15 years in prison, a $250,000 fine and may be forced to forfeit 16,000 pounds of precious metals to the federal government.

FBI.gov reported in their release “Defendant Convicted of Minting His Own Currency,”

“Attempts to undermine the legitimate currency of this country are simply a unique form of domestic terrorism,” U.S. Attorney Tompkins said in announcing the verdict. “While these forms of anti-government activities do not involve violence, they are every bit as insidious and represent a clear and present danger to the economic stability of this country,” she added. “We are determined to meet these threats through infiltration, disruption, and dismantling of organizations which seek to challenge the legitimacy of our democratic form of government.”

What’s democratic about past politicians propping up desperate, failed businessmen and selling them the ability to control two-third of the world’s savings? I don’t remember giving my consent to that contract. At what point, during any part of the history of central banking in the United States was there a democratic process?

Bitcoin is a peaceful, nonviolent, way of withdrawing from a system that snowballs your tax dollars into fighting foreign wars to maintain an outdated, failing monetary policy. It’s storing your wealth in a place soldiers, and spies cannot reach. It’s securing your present wealth from the mismanagement of other human beings who have never met you, who care nothing for you and know nothing about you. They make decisions that have a greater effect on your life than your own. Participating in Bitcoin is volunteering to be the guinea pig for what you hope is a better, brighter future, with just that much less violence in it for ourselves and our kids.

A benign decentralized autonomous software that maintains a scarce digital resource backed by nothing and supported by a network of impartial processing power isn’t the epitome of money. But It’s just a hell of a lot better than a currency backed by bombs.

Images from Shutterstock, Wikimedia & others.